What is slippage in Forex Trading

Although you may have been trading forex for years, it may be the first time you are reading about 'slippage'. Slippage is a common occurrence in forex trading, often talked about, but fairly misunderstood by many. It doesn't matter the asset class you trade, whether it's stock, forex, indices or futures, slippage occurs everywhere. Forex traders must be aware of slippage in order to minimize the negative effect while potentially maximizing positive effect.

In this article, we examine slippage and discuss the practical steps to reduce slippage exposure and also benefit from them. We will also explore the concept to provide readers with detailed information about slippages and how to mitigate their adverse effects.

What is slippage in Forex trading?

Slippage occurs when a trade order is filled at a price that is different from the requested price. This occurrence ensues occasionally during periods of high volatility where orders are unlikely to be matched at desired price levels. When slippages occur, forex traders tend to see it from a negative point of view despite the fact that it can equally be of profit.

How Does Slippage Work?

Slippage occurs when there is execution delay of market orders due to rapid market fluctuations that significantly adjust the intended execution price. When forex trading orders are sent out from brokers trading platforms to the forex market, the trade orders get triggered at the most available fill price that is provided by the market makers. The fill price may be above, below or exactly at the requested price. Slippage does not imply negative or positive price movement rather it describes the difference between the requested price and the executed price of a market order.

Putting this concept into numerical context; assume that we attempt to buy GBP/USD at the current market price of 1.1900. There are three possible outcomes that can result from the entry of the market order. They are

(1) No slippage

(2) Negative slippage

(3) Positive slippage

We will explore these outcomes in more depth.

Outcome 1: No slippage

This is a perfect trade execution where there is no slippage between the best available price and the requested price. Therefore, this implies that a buy or sell market order that was entered at 1.1900, will be executed at 1.1900.

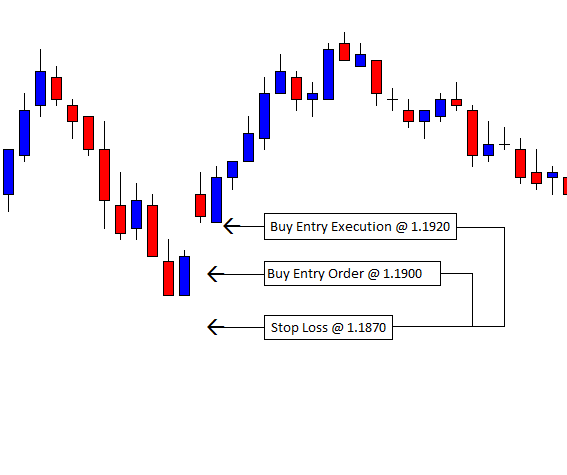

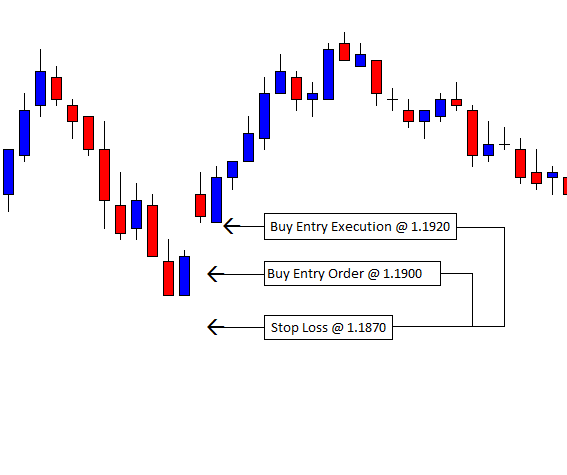

Outcome 2: Negative slippage

This happens when a buy market order is submitted and the best available price is suddenly offered above the requested price or when a sell market order is submitted and the best available price is suddenly offered below the requested price.

Using a long position on GBPUSD as an example, if a buy market order is executed at 1.1900, and the best available price for the buy market order suddenly changes to 1.1920 (20 pips above the requested price), the order is then filled at a higher price of 1.1920.

If the take profit was projected at 100 pips of bullish price movement, it now becomes 80 pips and if the stop loss was initially set to be 30 pips, it now becomes 50 pips. This type of slippage has negatively reduced the potential profit and increased the potential loss.

Outcome 3: Positive slippage

This happens when a buy market order is submitted and the best available price is suddenly offered below the requested price or when a sell market order is submitted and the best available price is suddenly offered above the requested price.

Using a long position on GBPUSD as an example, if a buy market order is executed at 1.1900, and the best available price for the buy market order suddenly changes to 1.1890 (i.e. 10 pips below the requested price), the order is then filled at this better price of 1.1890.

If the take profit was projected at 100 pips of price move, it now becomes 110 pips of price move and if the stop loss was set to be 30 pips, it now becomes 20 pips. This type of slippage has helped to maximize potential profit and minimize potential loss!

Why do slippages occur?

What causes forex slippages, and why do market orders sometimes open at a different price level from the price we requested? It comes down to what a true market is all about: ‘buyers and sellers’. For a market order to be efficient, every buy orders must have an equal number of sell orders at the same size and price. Any imbalance between the size of buy and sell orders at any price level will cause price movement to fluctuate rapidly, increasing the chances of slippages.

If you attempt to buy 100 lots of GBP/USD at 1.6650, and there is not enough counterparty liquidity to sell GBP at 1.6650 USD, your market order will look at the next best available price and buy GBP at a higher price, resulting in a negative slippage.

If the size of the counterparty liquidity looking to sell their Pounds was greater at the time your order was submitted, your market order might be able to find a price lower to buy thus resulting in a positive slippage.

Stop loss slippage can also happen when a stop loss level is not honored. Most brokers trading platforms are known to honor guaranteed stop losses as opposed to normal stop losses. Guaranteed stop losses are filled regardless of the underlying market's conditions and brokers take responsibility for any stop loss that is incurred as a result of slippage.

Here are some tips to avoid slippage

It is essential to factor slippage into your trading plan because it is unevitable. You'll also have to factor slippage into your final trading costs, along with other costs like spreads, fees, and commissions. Using the average slippage you experienced over the course of a month or longer can help you figure out your trading costs. Having this information will enable you to estimate how much profit you need to make.

- Select a different market order type: Slippage occurs when trading with market orders. So to avoid slippage and eliminate the risk of negative slippage, you must trade with limit orders to get your entry price filled where you requested.

- Avoid trading around major news releases: In most cases, the biggest slippage usually takes place around major market news events. You should monitor the news about the asset you wish to trade to have a clear sense of the direction of price movement and to help identify and steer clear of high volatile periods. Market orders should be avoided during high-profile news events, such as FOMC announcements, Non-farm payrolls or earnings announcements. The resulting big moves may appear enticing, but getting your entries and exits at your desired price with market orders will be very difficult. In the event that a trader has already taken a position during the time of the news release, they are likely to experience stop loss slippage, which entails a much higher level of risk than they expected.

- Ideally trade in a highly liquid and low volatility market: In a low-volatility market environment, traders are able to limit slippage risk because price movement in this type of market is smooth and not erratic. Furthermore, highly liquid markets are likely to execute orders at the requested price due to active participants on both sides.

Liquidity is always high in the forex market, especially during the London Open, New York Open, and overlapping sessions. Slippages are most likely to occur overnight or during weekends so it is good for traders to avoid holding trade positions overnight and through the weekend.

- Consider using a VPS (Virtual Private Server): With VPS services, traders can also ensure the best execution at all times regardless of technical mishaps, such as internet connectivity problems, power failures, or computer malfunctions. Due to FXCC's optical fibre connectivity, traders can run and execute orders at high speeds. Using a VPS is ideal because it can be accessed 24/7 from anywhere around the world.

Which financial asset is least susceptible to slippage?

A more liquid financial asset class, such as currency pairs (EURUSD, USDCHF, AUDUSD, etc.), is less susceptible to slippage under normal market circumstances. Although, during times of high market volatility, like before and during an important data release, these liquid currency pairs can be vulnerable to slippage.

Summary

As a trader, you cannot avoid slippage. It is called slippage when the price at which an order was requested differs from the price at which the order was executed.

Slippage can be positive as well as negative. The best way to minimize your exposure to slippage is to trade during peak trading hours and only markets that are highly liquid and preferably at moderate volatility.

The use of guaranteed stops and limit orders helps to protect trades from the effect of slippage. Limit orders can be used to prevent slippage but it carries an inherent risk of trade setups not being executed if the price movement does not meet the limit entry price level.