Volatility index indicator

In financial markets, volatility is a critical metric, reflecting the degree of price variation over a given period. It serves as a barometer of market uncertainty, providing insights into investor sentiment and potential price movements. Among the tools used to gauge volatility, the Volatility Index (VIX) has gained prominence as an essential indicator for traders across various asset classes. Often referred to as the "Fear Index," the VIX measures expected volatility in the market, offering a window into the collective psyche of market participants.

The Volatility Index Indicator, originally developed by the Chicago Board Options Exchange (CBOE), is a cornerstone for understanding market sentiment. While its primary focus is on the stock market, its implications extend to forex trading, commodities, and other financial instruments. By analyzing the VIX, traders can anticipate periods of heightened market activity or stability, helping them to make informed decisions.

From identifying trends to hedging against risks, the VIX provides actionable insights into market dynamics. Moreover, its integration with other technical and fundamental indicators enhances its effectiveness, making it a valuable addition to any trader’s toolkit.

What is the volatility index indicator?

The Volatility Index (VIX), often called the "Fear Index," is a benchmark used to gauge market expectations of near-term volatility. Originally developed by the Chicago Board Options Exchange (CBOE) in 1993, the VIX reflects anticipated fluctuations in the S&P 500 Index over the next 30 days. Unlike traditional indicators that analyze historical price data, the VIX derives its value from implied volatility, which is extracted from S&P 500 options prices.

At its core, the VIX serves as a measure of market sentiment, capturing traders' expectations of uncertainty or stability. When the VIX value is low, it indicates that investors foresee calmer markets with minimal price swings. Conversely, a high VIX suggests heightened uncertainty, often driven by geopolitical events, economic data releases, or unexpected market shocks. This dynamic makes the VIX a valuable tool for predicting potential turning points in market behavior.

The indicator has gained widespread use among traders due to its versatility. While it primarily reflects sentiment in the equity markets, its influence extends to other asset classes, including forex and commodities. For instance, forex traders often monitor the VIX to gauge risk sentiment, as currencies like the USD and JPY tend to react significantly during periods of increased volatility.

How the volatility index works

The Volatility Index (VIX) operates as a forward-looking measure, designed to estimate market volatility over the next 30 days. Unlike traditional metrics that rely on historical price movements, the VIX is derived from the implied volatility of options contracts on the S&P 500 Index. Implied volatility reflects traders' expectations of future price swings, making the VIX an anticipatory gauge of market conditions.

The calculation of the VIX involves a complex formula that aggregates the weighted prices of out-of-the-money put and call options across various strike prices. These options are part of the S&P 500 Index, which represents a diverse cross-section of the U.S. economy. The result is a single value expressed as an annualized percentage, offering a snapshot of expected market turbulence.

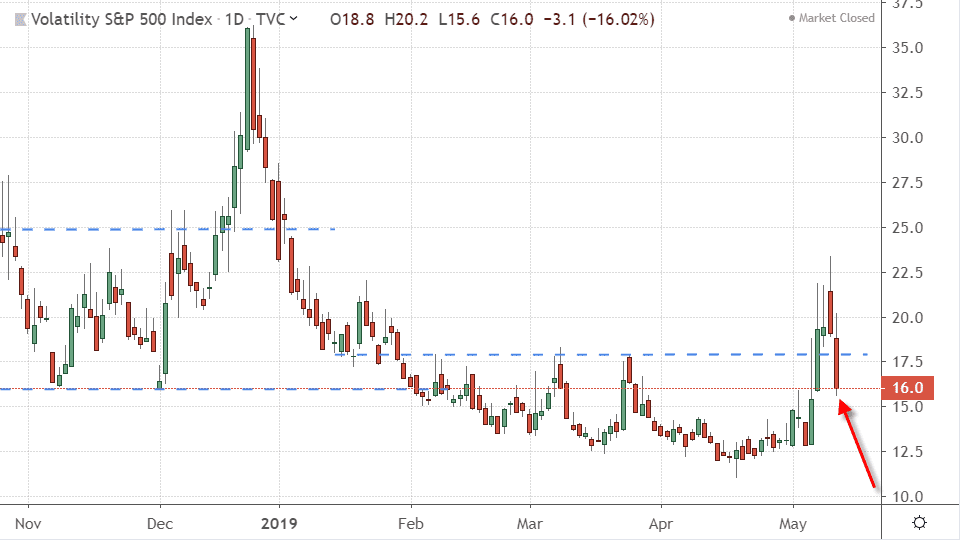

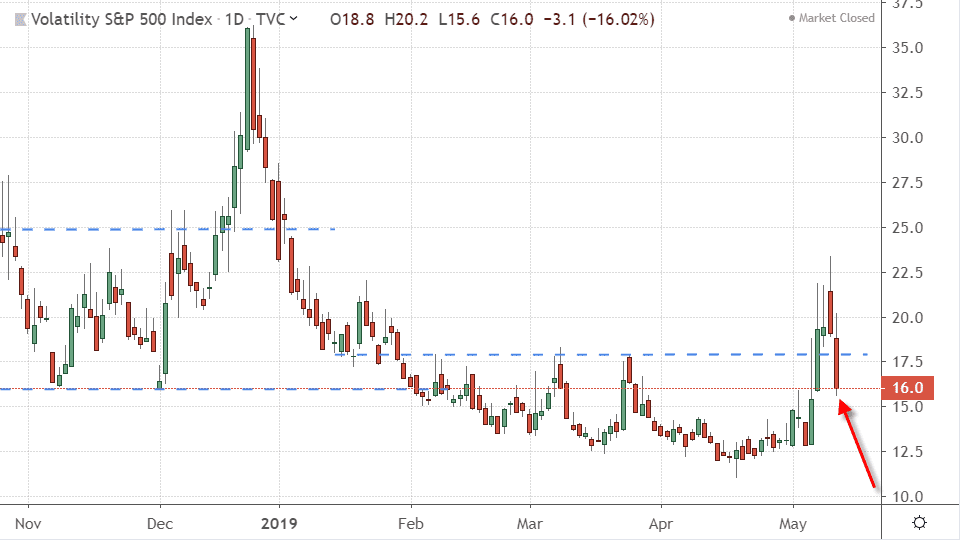

Interpreting the VIX is crucial for traders. A low VIX value, typically below 15, indicates stable market conditions with limited fluctuations. In contrast, a VIX above 20 suggests heightened uncertainty, often signalling increased risk aversion among investors. Extreme spikes in the VIX are often associated with significant market events, such as financial crises or geopolitical shocks.

Importantly, the VIX is not a directional indicator; it does not predict whether markets will rise or fall. Instead, it provides a measure of the intensity of price movements, which traders can use to refine their strategies.

Why traders use the volatility index indicator

The Volatility Index (VIX) has become an indispensable tool for traders seeking to understand market dynamics and navigate uncertainty. Its ability to quantify market sentiment provides insights into the psychological state of investors, which can significantly impact asset prices. By interpreting the VIX, traders can anticipate periods of increased market activity or relative calm, enabling them to adapt their strategies effectively.

One primary use of the VIX is in risk management. During periods of high volatility, reflected by a rising VIX, traders can take defensive positions to protect their portfolios. For example, options traders might hedge their positions using VIX futures or options, which are directly tied to the index. In contrast, during low-volatility periods, traders may adopt strategies that capitalize on market stability, such as selling options to earn premium income.

The VIX also serves as a leading indicator for market sentiment. A sudden spike in the VIX often signals a shift in investor behavior, such as moving from risk-on to risk-off assets. In forex trading, this shift can manifest in increased demand for safe-haven currencies like the USD or JPY. Conversely, a declining VIX might indicate growing investor confidence, supporting riskier currencies.

Popular volatility index strategies for traders

Mean reversion strategy

The VIX often exhibits a tendency to revert to its long-term average. Traders utilizing this approach look for extreme VIX readings—either unusually high or low—as potential signals of a market reversal. For instance, a spike in the VIX could indicate panic selling, suggesting that market stability may soon return.

Breakout strategy

Significant movements in the VIX can act as a harbinger of directional trends in the underlying market. A sudden upward breakout in the VIX often signals heightened uncertainty, prompting traders to adopt defensive positions or take advantage of volatility-driven opportunities in options markets.

Hedging with VIX derivatives

The availability of VIX futures and options allows traders to hedge against portfolio losses during turbulent markets. By holding positions in VIX derivatives, traders can offset potential declines in equities or other asset classes.

Contrarian strategy

High VIX readings are sometimes viewed as a contrarian signal, where extreme fear in the market might suggest a bottoming process. Traders adopting this strategy often combine VIX analysis with other indicators to identify buying opportunities.

Integrating the volatility index in forex trading

Although the Volatility Index (VIX) is primarily associated with equity markets, its influence extends to forex trading, making it a valuable tool for currency traders. By monitoring the VIX, forex traders gain insights into global market sentiment, which often drives currency flows between riskier and safer assets.

One of the most significant connections between the VIX and forex markets lies in its ability to signal risk-on and risk-off conditions. During high VIX periods, indicating elevated market volatility, investors typically seek refuge in safe-haven currencies such as the U.S. dollar (USD) or Japanese yen (JPY). For example, if geopolitical tensions or economic uncertainty push the VIX upward, traders may observe a corresponding rise in demand for these currencies.

Conversely, a declining VIX often points to improved investor confidence, prompting increased demand for higher-yielding currencies like the Australian dollar (AUD) or New Zealand dollar (NZD). Traders can leverage these correlations to anticipate shifts in forex pair movements and align their strategies accordingly.

Moreover, combining VIX readings with technical tools like moving averages or the Relative Strength Index (RSI) can provide a more comprehensive view of market conditions. Platforms offering access to real-time VIX data further empower traders to respond swiftly to changes in volatility.

Challenges of using the volatility index

While the Volatility Index (VIX) is a powerful tool for assessing market sentiment and expected volatility, it is not without its challenges and limitations. Traders must approach the VIX with a clear understanding of its nuances to avoid potential pitfalls.

One significant limitation is that the VIX is not a directional indicator. It measures the intensity of market volatility but does not provide information on whether prices will move up or down. This means traders must rely on other technical and fundamental analysis tools to form a complete picture of market trends.

Additionally, the VIX is based on implied volatility derived from S&P 500 options, which means it reflects expectations rather than certainties. Factors such as sudden geopolitical events, unexpected economic data, or central bank interventions can cause rapid and unanticipated changes, rendering the VIX less reliable in certain contexts.

Another challenge lies in over-reliance on the VIX as a standalone indicator. Traders who fail to combine VIX insights with other market data may misinterpret signals, leading to suboptimal trading decisions. For instance, a rising VIX could be a reaction to short-term fear rather than a sustained trend, potentially misleading traders.

Finally, VIX derivatives, such as futures and options, can carry unique risks, including low liquidity during certain periods and complex pricing mechanisms. These factors can amplify losses if not carefully managed.

Conclusion

The Volatility Index (VIX) serves as a vital tool for traders seeking to navigate the complexities of financial markets. As a measure of expected market volatility, it provides insights into investor sentiment, helping traders anticipate periods of turbulence or calm. By understanding the VIX and integrating it into trading strategies, market participants can make more informed decisions, whether their goal is to capitalize on volatility, hedge against risks, or diversify their approach to different asset classes.

In forex trading, the VIX offers additional value as a barometer of global risk sentiment. Its movements often influence currency pair dynamics, especially involving safe-haven and high-yielding currencies. This makes the VIX an invaluable component of a forex trader’s toolkit, allowing for enhanced market analysis and improved risk management.