The top techniques of forex market analysis

The main purpose of the forex market is to enable companies to convert currencies for international trade and investment. Moreover, it provides chances for investors to speculate and make money from changes in currency values.

Traders need to conduct thorough market analysis to be successful in the forex market. Depending on intuition or guesswork when it comes to currency fluctuations can result in substantial financial losses due to the unpredictability and intricate nature of the market. Market analysis provides traders with the necessary tools and knowledge to make well-informed decisions, ultimately increasing their likelihood of achieving positive results. By comprehending the basic factors influencing currency values, traders can predict market trends and create strategies that match their risk tolerance and investment objectives.

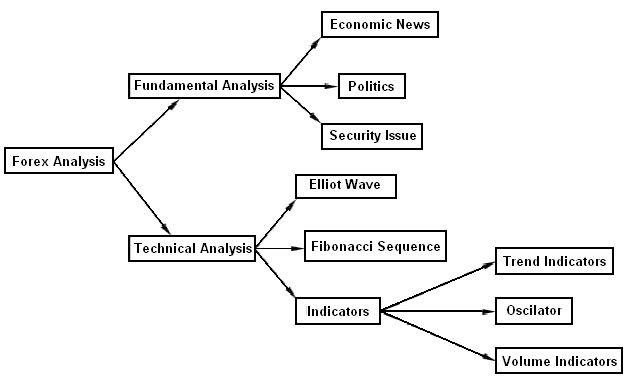

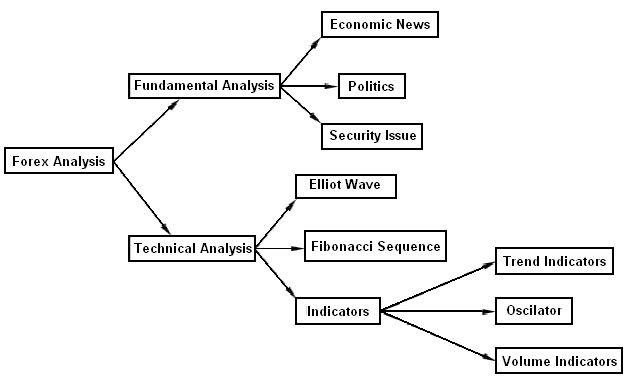

Fundamental analysis

Fundamental analysis in the forex market involves evaluating the intrinsic value of a currency by examining economic, social, and political factors that influence its price. This approach seeks to understand the underlying drivers of currency movements and predict future price actions based on these factors.

Key components of fundamental analysis include economic indicators, interest rates, and political events. Economic indicators such as Gross Domestic Product (GDP), employment rates, and inflation provide insights into a country's economic health. Interest rates, set by central banks, are critical as they influence currency value by affecting investment flows. Political events, including elections, policy changes, and geopolitical tensions, can cause significant currency fluctuations due to the uncertainty they create.

Traders use various tools and resources to conduct fundamental analysis. Economic calendars list upcoming economic events and releases, helping traders anticipate market impacts. News websites offer real-time information on economic developments and political events. Government reports, such as those from central banks and statistical agencies, provide authoritative data on economic conditions.

Fundamental analysis affects currency values by highlighting the economic strengths or weaknesses of a country, thereby influencing investor confidence. For example, a country with strong economic indicators and stable political conditions is likely to see its currency appreciate. Conversely, negative indicators or political instability can lead to depreciation.

An example of successful fundamental analysis is the anticipation of the US dollar’s strength due to the Federal Reserve’s interest rate hikes in recent years. Traders who understood the impact of rising interest rates on currency value were able to capitalize on the dollar's appreciation, demonstrating the practical application of fundamental analysis in forex trading.

Technical analysis

Technical analysis in the forex market involves studying historical price data to forecast future price movements. Unlike fundamental analysis, which focuses on economic and political factors, technical analysis relies on the assumption that all relevant information is already reflected in the price. Thus, price movements follow patterns that can be identified and used to predict future behavior.

Key components of technical analysis include charts, price patterns, and technical indicators. Charts are the primary tools used by technical analysts, displaying price movements over various time frames. Common types of charts include line charts, bar charts, and candlestick charts. Price patterns, such as head and shoulders, double tops, and triangles, help identify potential trend reversals or continuations. Technical indicators, like Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), provide additional insights into market momentum, volatility, and potential entry and exit points.

Tools and resources for technical analysis are widely available. Charting software, such as MetaTrader and TradingView, offers advanced charting capabilities and access to a range of technical indicators. These tools enable traders to analyze market trends, set alerts, and test trading strategies.

Technical analysis helps predict market movements by identifying trends and patterns that tend to repeat over time. For example, if a currency pair consistently bounces off a particular support level, traders might predict it will do so again, leading to a buy signal. Conversely, if a currency pair breaks through a resistance level, it may indicate a potential sell opportunity.

An example of technical analysis in action is using the Moving Average Crossover strategy. When the short-term moving average crosses above the long-term moving average, it signals a potential uptrend, prompting traders to buy. Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a potential downtrend, leading traders to sell. This method has been successfully employed by many traders to identify profitable trading opportunities in the forex market.

Sentiment analysis

Sentiment analysis in the forex market involves gauging the overall mood or attitude of traders towards a particular currency pair. This approach goes beyond the data and focuses on the psychology and emotions driving market participants, providing a different perspective on potential market movements.

Key components of sentiment analysis include market sentiment indicators, trader positioning, and social media sentiment. Market sentiment indicators, such as the Commitment of Traders (COT) report, offer insights into the positioning of large traders and institutions. Trader positioning data, often provided by brokers, shows the aggregate positions of their clients, revealing whether retail traders are predominantly long or short. Social media sentiment involves analyzing discussions on platforms like Twitter, Reddit, and trading forums to gauge the mood of retail traders.

Various tools and resources can aid in sentiment analysis. Sentiment indices, such as the Fear and Greed Index, provide a snapshot of the market's emotional state. Broker reports on trader positioning, available from many forex brokers, offer valuable insights into the current market bias. Social media and forum analysis tools help monitor real-time discussions and sentiment trends among traders.

Sentiment analysis provides insights into market psychology by highlighting the prevailing emotions driving market behavior. For instance, if sentiment indicators show extreme bullishness, it might suggest that the market is overbought and due for a correction. Conversely, extreme bearish sentiment could indicate an oversold market poised for a rebound.

An example of sentiment analysis impacting trading decisions is observing a sudden shift in trader positioning data. If a significant majority of traders are long on a currency pair, it might signal a potential reversal, as the market could be overextended. Conversely, if social media sentiment turns overwhelmingly negative on a currency, it could indicate a buying opportunity as pessimism reaches its peak. By incorporating sentiment analysis into their strategy, traders can better understand and anticipate market movements influenced by collective trader psychology.

Comparing the techniques

When comparing fundamental, technical, and sentiment analysis, each technique has its own set of advantages and disadvantages, making them suitable for different trading scenarios.

Advantages and disadvantages:

- Fundamental analysis:

- Advantages: Provides a deep understanding of economic conditions and long-term trends. Helps identify intrinsic currency value.

- Disadvantages: Time-consuming and requires understanding complex economic indicators. Less effective for short-term trading.

- Technical analysis:

- Advantages: Useful for short-term trading and identifying precise entry and exit points. Easy to apply with various tools and indicators.

- Disadvantages: Can generate false signals in volatile markets. Does not consider underlying economic factors.

- Sentiment analysis:

- Advantages: Offers insights into market psychology and potential reversals. Complements other analysis techniques.

- Disadvantages: Sentiment can change rapidly and be difficult to quantify accurately. Relies heavily on data interpretation.

Situations where each technique is most effective:

- Fundamental analysis: Best for long-term investment decisions and understanding major market trends. Effective during significant economic events like interest rate decisions.

- Technical analysis: Ideal for short-term trading strategies and identifying trend continuations or reversals. Useful in stable, trending markets.

- Sentiment analysis: Most effective during extreme market conditions and potential turning points. Helps gauge market overreactions and corrections.

Combining techniques for a more comprehensive analysis: By integrating all three techniques, traders can achieve a more holistic view of the market. For example, combining fundamental analysis with technical signals can validate entry points and reduce false signals. Sentiment analysis can further refine these strategies by highlighting market mood and potential reversals.

Practical application for traders

Conducting a comprehensive market analysis involves several steps to ensure informed trading decisions. By using multiple techniques, traders can develop a robust strategy that accounts for various market factors.

Steps to conduct a comprehensive market analysis:

- Start by collecting data from reputable sources. Use economic calendars for upcoming events, news websites for recent developments, and broker reports for market sentiment.

- Evaluate economic indicators, interest rates, and political events to understand the underlying value of currencies.

- Use charting software to identify trends, patterns, and technical indicators that signal potential entry and exit points.

- Assess market sentiment through sentiment indices, trader positioning reports, and social media analysis to gauge the prevailing market mood.

Importance of using multiple techniques: Combining fundamental, technical, and sentiment analysis provides a well-rounded view of the market. While fundamental analysis offers insights into long-term trends, technical analysis helps with timing trades, and sentiment analysis highlights market psychology. This integrated approach reduces reliance on a single method and increases the accuracy of predictions.

Common pitfalls to avoid:

- Over-reliance on one technique: Relying solely on one method can lead to missed signals or false predictions. Diversify your analysis.

- Ignoring market sentiment: Market mood can drive short-term movements, so always consider sentiment alongside other analyses.

- Neglecting economic events: Major economic events can disrupt technical patterns and sentiment trends, so stay informed.

Developing a personalized analysis strategy: Create a strategy tailored to your trading style and risk tolerance. Combine the techniques in a way that suits your goals. For instance, a day trader might prioritize technical and sentiment analysis, while a long-term investor focuses more on fundamental factors.

Real-world Examples:

- Example 1: A trader uses fundamental analysis to anticipate a currency's strength due to strong economic performance. Technical analysis confirms an upward trend, and sentiment analysis shows increasing bullish sentiment, leading to a successful long position.

- Example 2: During a period of market uncertainty, a trader notices extreme bearish sentiment. Technical analysis indicates oversold conditions, and fundamental analysis supports a recovery, resulting in a profitable short-term buy.

Conclusion

A balanced approach that integrates all three techniques—fundamental, technical, and sentiment analysis—offers a comprehensive view of the market. By leveraging the strengths of each method, traders can mitigate risks and enhance their trading performance. For instance, fundamental analysis can identify long-term trends, technical analysis can optimize trade timing, and sentiment analysis can provide context for market behavior.

In conclusion, adopting a multifaceted analysis strategy and committing to ongoing education are key to navigating the complexities of the forex market. By combining different analytical approaches, traders can make more informed decisions, adapt to market changes, and ultimately achieve better trading outcomes.