Standard Deviation Indicator

The Standard Deviation Indicator known for its ability to measure price volatility, this indicator empowers traders to anticipate potential market reversals or periods of consolidation. At its core, the Standard Deviation Indicator analyzes the dispersion of price data from its mean, providing a clear picture of market volatility. When price movements are highly volatile, the indicator reflects a high standard deviation; during quieter periods, it signals a lower value. Such information is critical for traders who want to identify potential breakout opportunities or confirm the strength of prevailing trends.

Incorporating the Standard Deviation Indicator into a forex strategy can enhance risk management, improve timing, and refine decision-making processes. Whether used alone or in combination with other technical tools, it offers a versatile approach to navigating diverse market conditions.

Understanding the standard deviation indicator

The Standard Deviation Indicator is a powerful statistical tool that measures the extent of price volatility in the forex market. Derived from statistical principles, it calculates the degree to which current prices deviate from their average over a specified period. In simpler terms, it quantifies the dispersion of prices, providing traders with a snapshot of how "spread out" or concentrated market movements are at any given time.

The mathematical foundation of the Standard Deviation Indicator involves calculating the square root of the average of squared deviations from the mean. While this may sound complex, trading platforms like MetaTrader 4 (MT4) perform these calculations automatically, displaying the results as a line on the chart. The resulting values represent the intensity of price fluctuations: higher values indicate significant market volatility, while lower values suggest a stable or consolidating market.

For forex traders, understanding market volatility is critical. Volatile markets often present opportunities for high rewards but also come with increased risk. Conversely, periods of low volatility may indicate consolidation, signaling the potential for upcoming breakout trends. The Standard Deviation Indicator is especially valuable in pinpointing these scenarios, helping traders time their entries and exits with precision.

How the standard deviation indicator works in forex

The Standard Deviation Indicator functions by assessing price volatility over a selected period, offering traders a clearer view of market dynamics. By calculating how far prices deviate from their average, the indicator generates values that help traders interpret the intensity and nature of price movements.

When the indicator reflects a high standard deviation, it signals significant volatility, often tied to major market events or strong price trends. For instance, a high value may occur during economic data releases, central bank announcements, or geopolitical developments that disrupt market stability. Such periods are characterized by rapid price shifts, which can present trading opportunities but also require careful risk management.

In contrast, a low standard deviation suggests reduced price volatility, often linked to consolidating markets. During these phases, prices tend to hover within narrow ranges, indicating indecision among market participants. This can signal the buildup to a breakout, providing traders with potential entry points for future trends.

The indicator’s output is typically displayed as a line on the chart, moving in tandem with price fluctuations. Traders can use this visual representation to identify patterns, such as spikes indicating heightened activity or prolonged low values hinting at stagnation.

Standard deviation indicator strategy

The Standard Deviation Indicator is an integral part of various trading strategies in the forex market, offering a useful approach to analyzing price volatility and improving decision-making. Its primary use lies in identifying periods of heightened market activity and signaling potential trend reversals or breakout opportunities.

One popular strategy involves combining the Standard Deviation Indicator with Moving Averages to assess the strength and direction of trends. For example, when a moving average aligns with rising standard deviation values, it indicates that the market is experiencing strong, directional momentum. Traders can use this information to enter positions in the trend’s direction, maximizing their profit potential during volatile periods.

Another effective approach uses the indicator to gauge overbought or oversold conditions. During high volatility, sharp price movements may temporarily push prices to unsustainable levels. Traders can pair the Standard Deviation Indicator with tools like the Relative Strength Index (RSI) to confirm these extremes and time their entries or exits accordingly.

The Standard Deviation Indicator is also instrumental in risk management. By measuring volatility, traders can adjust their position sizes to suit current market conditions. For instance, during periods of low standard deviation, smaller price movements may warrant tighter stop-loss levels, while high volatility may require wider stops to accommodate larger swings.

How to use the standard deviation indicator in MT4

The Standard Deviation Indicator is widely available on trading platforms like MetaTrader 4 (MT4), making it accessible to forex traders of all levels. Understanding how to set up and utilize this tool effectively on MT4 can significantly enhance your trading strategies.

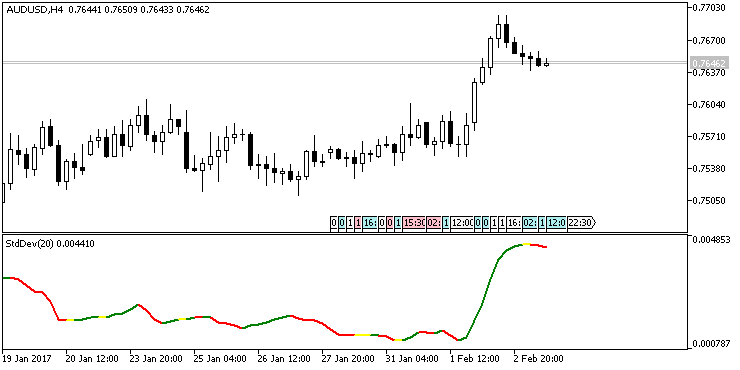

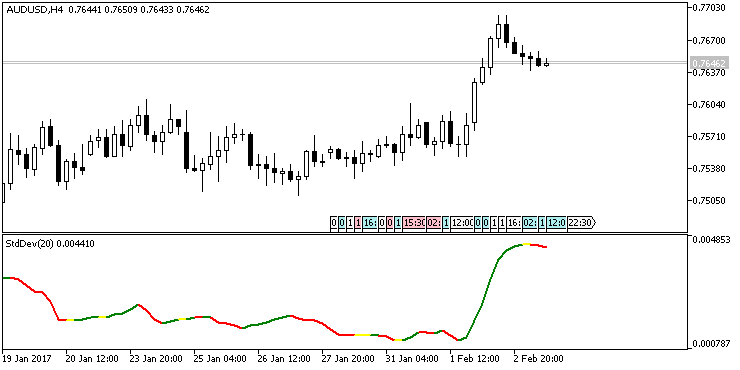

To begin, launch the MT4 platform and navigate to the "Insert" menu. From there, select "Indicators," followed by "Trend," and then choose "Standard Deviation." The indicator will appear on your chart as a line below the price action, moving up and down in response to price volatility.

Once applied, you can customize the indicator’s settings to suit your trading style. The default period is often set to 20, but this can be adjusted based on your analysis needs. For example, shorter periods may capture quick changes in volatility, while longer periods smooth out fluctuations, focusing on broader market trends.

Interpreting the Standard Deviation Indicator in MT4 involves observing its peaks and troughs. High peaks indicate increased volatility, signaling potential breakouts or trend strength. Low troughs, on the other hand, suggest a calm market, often preceding significant price movements.

For traders who use multiple indicators, MT4 allows seamless integration of the Standard Deviation Indicator with other tools. For instance, pairing it with Bollinger Bands can provide deeper insights into price behavior, as both rely on standard deviation to assess market dynamics.

Advantages and limitations of the standard deviation indicator

The Standard Deviation Indicator is a popular tool in forex trading, valued for its ability to measure market volatility. However, like all technical indicators, it has both advantages and limitations that traders should consider before integrating it into their strategies.

One of the primary advantages of the Standard Deviation Indicator is its simplicity. By calculating the dispersion of prices around their average, it provides a clear, visual representation of market volatility. This makes it particularly useful for identifying breakout opportunities during periods of consolidation or gauging the strength of ongoing trends. Additionally, the indicator is versatile and can be paired with other tools, such as Moving Averages or Bollinger Bands, to create more comprehensive trading strategies.

Another key benefit is its role in risk management. Traders can use standard deviation values to adjust their position sizes or set stop-loss levels, ensuring their strategies align with the current level of market volatility. For instance, higher standard deviation values may prompt traders to widen their stops, while lower values suggest a tighter range.

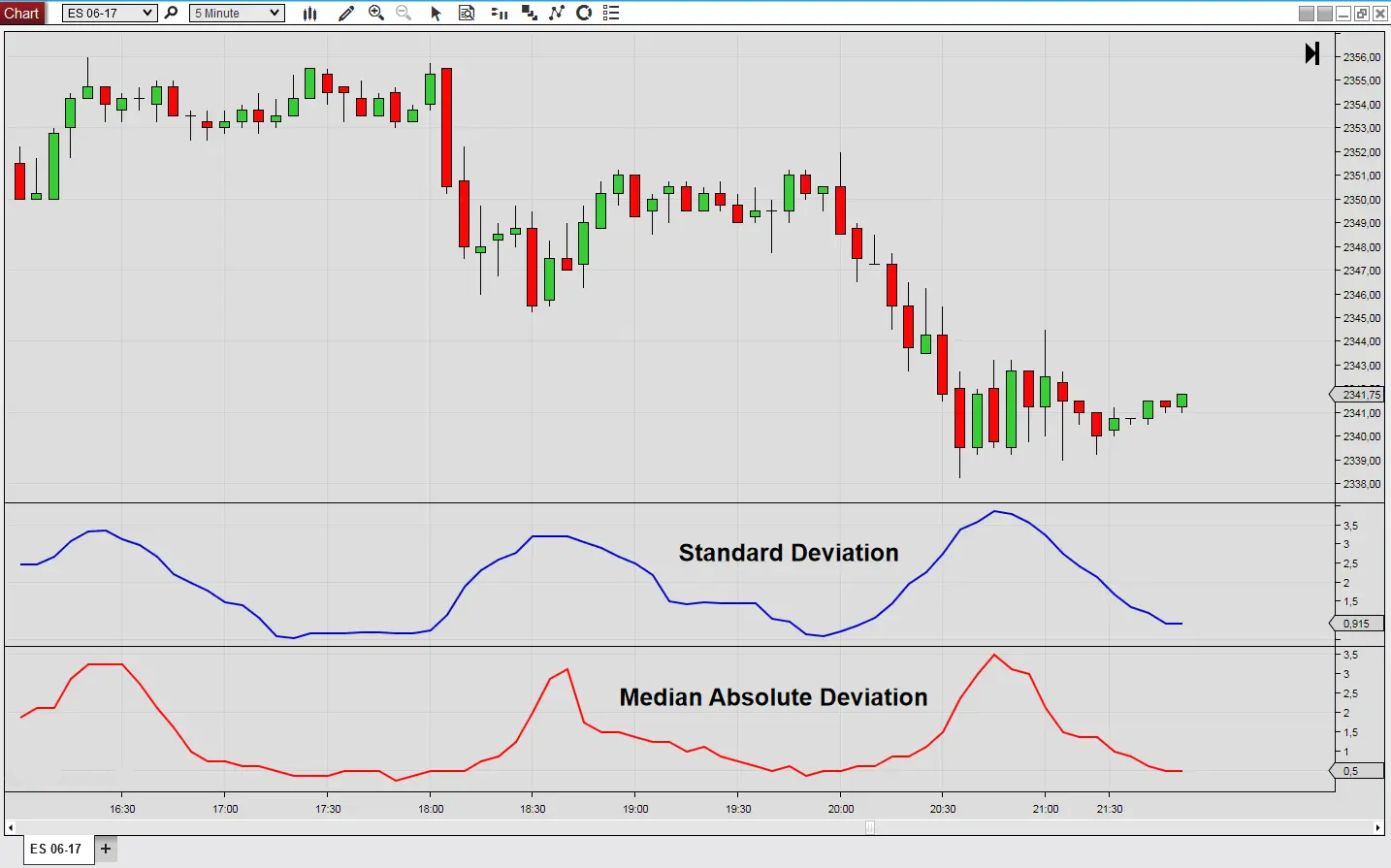

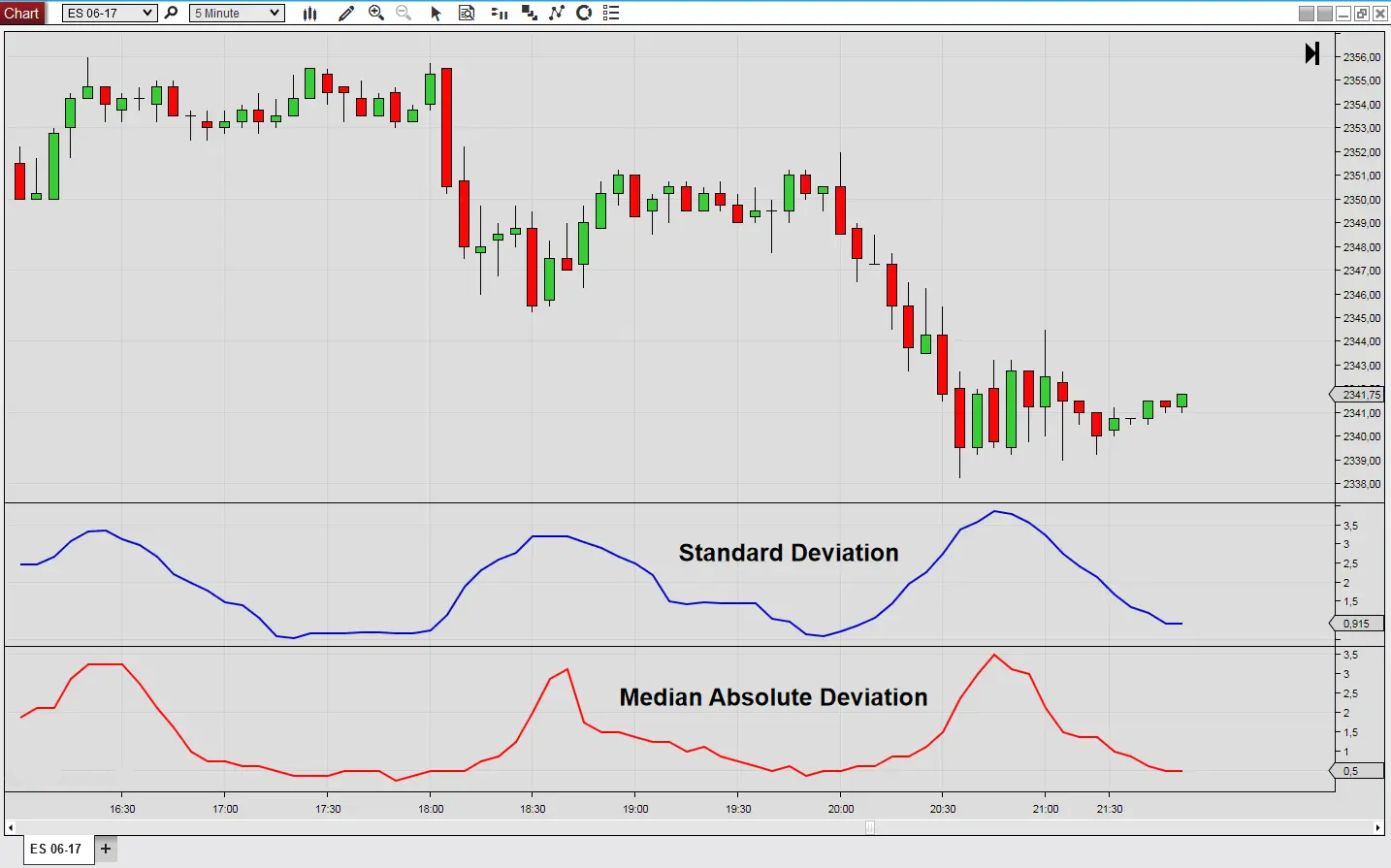

However, the Standard Deviation Indicator also has limitations. As a lagging indicator, it relies on historical data, which means it may not always provide timely signals in speeding markets. This lag can lead to false signals, especially during sudden, short-lived market events. Additionally, the indicator does not inherently suggest market direction, requiring traders to combine it with trend or momentum indicators for a complete analysis.

Best practices for using the standard deviation indicator in forex

Adopting best practices ensures traders maximize its potential while minimizing the risks of misinterpretation.

Combine with complementary indicators

The Standard Deviation Indicator works best when paired with other technical tools. For instance, combining it with trend-following indicators like Moving Averages or Bollinger Bands can provide a clearer picture of market conditions. A rising standard deviation coupled with a moving average crossover may signal the start of a strong trend.

Adapt strategies to trading styles

Different trading styles, such as scalping, day trading, or swing trading, require specific adaptations of the indicator. For scalpers, shorter periods on the Standard Deviation Indicator can highlight quick bursts of volatility, while swing traders may prefer longer periods to capture broader market trends.

Incorporate macroeconomic analysis

Volatility often spikes during major economic events, such as central bank announcements or geopolitical developments. By monitoring macroeconomic calendars alongside the Standard Deviation Indicator, traders can anticipate potential volatility shifts and adjust their strategies accordingly.

Avoid over-reliance

While the Standard Deviation Indicator is powerful, it is not infallible. Relying solely on it can lead to misjudged entries or exits. Traders should use it as part of a comprehensive trading system that includes multiple indicators and solid risk management practices.

Conclusion

The Standard Deviation Indicator is a versatile and powerful tool for forex traders, providing essential insights into market volatility and helping to refine trading strategies. By measuring the dispersion of price movements around their average, it equips traders with a clear understanding of when markets are experiencing heightened activity or periods of consolidation. This information is invaluable for identifying breakout opportunities, assessing trend strength, and managing risk effectively.

One of the indicator’s greatest strengths lies in its simplicity and adaptability. Available on widely used platforms like MetaTrader 4 (MT4), it is accessible to traders of all experience levels. Moreover, its ability to seamlessly integrate with other technical tools, such as Moving Averages and Bollinger Bands, makes it an excellent addition to any trading system.