New York Breakout Strategy

The New York breakout strategy is a popular forex trading approach designed to capitalize on the high volatility and liquidity of the New York trading session. As one of the most active trading sessions globally, the New York session plays a critical role in shaping daily price movements, particularly for currency pairs involving the U.S. dollar (USD). Traders are drawn to this strategy for its simplicity and potential to generate quick profits during periods of heightened market activity.

The New York trading session overlaps with the London session for several hours, creating a surge in trading volume as European and North American markets operate simultaneously. This overlap often leads to significant price fluctuations, making it an ideal environment for breakout trading. A breakout occurs when price moves beyond a defined range of support and resistance, signaling potential momentum in a specific direction.

The New York breakout strategy leverages this concept by identifying key price levels before the session begins and setting orders to capture market movements as they unfold. The strategy is especially appealing because it aligns with the release of major U.S. economic reports, such as non-farm payrolls and Federal Reserve announcements, which often drive sharp market reactions.

Understanding the New York trading session

The New York trading session is one of the most significant periods in the forex market, known for its high levels of liquidity and volatility. It begins at 8:00 AM EST and ends at 5:00 PM EST, coinciding with key financial activities in the United States. During this session, the forex market experiences intense trading activity, especially in currency pairs involving the U.S. dollar (USD), such as EUR/USD, GBP/USD, and USD/JPY.

A key feature of the New York session is its overlap with the London session, which occurs between 8:00 AM and 12:00 PM EST. This overlap creates a window of heightened market liquidity and activity, making it an attractive time for traders to implement breakout strategies. During these hours, large institutional traders, hedge funds, and banks are active, leading to strong price movements and clear trends.

Economic data releases play a significant role in shaping price action during the New York session. Reports such as the U.S. non-farm payrolls, consumer confidence, and Federal Reserve interest rate decisions often cause sharp price movements. Traders who follow the New York session breakout strategy closely monitor these events, as they can provide opportunities to enter trades when volatility peaks.

Core principles of the New York breakout forex trading strategy

The New York breakout forex trading strategy revolves around identifying and capitalizing on price movements that break through predefined support or resistance levels during the highly active New York trading session. At its core, this strategy is rooted in the principles of momentum trading, where traders seek to profit from strong directional price movements sparked by increased volatility and trading volume.

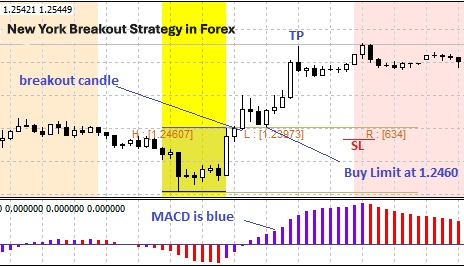

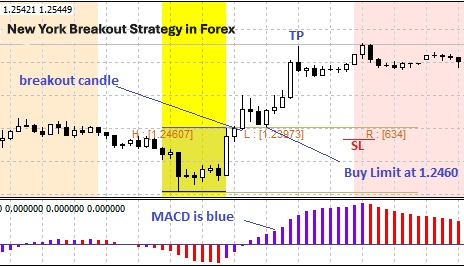

A breakout occurs when the price moves decisively beyond a range that has been established during a period of lower activity, often seen in the hours leading up to the New York session. This pre-market range, also known as the consolidation phase, provides key support and resistance levels that traders use as reference points. A breakout beyond these levels typically signals a shift in market sentiment, allowing traders to position themselves for potential trends.

One critical aspect of the strategy is identifying the pre-market range accurately. Traders often rely on technical analysis, drawing horizontal lines to mark the high and low points of the consolidation range. Some may use tools like Bollinger Bands or pivot points to confirm these levels.

Gide to implementing the New York breakout strategy

Successfully implementing the New York breakout strategy requires a structured approach and a strong grasp of market dynamics during the New York trading session.

Identify the pre-market range

Before the New York session begins, analyze price action during the Asian session or the overlap with the London session to determine the pre-market range. This range is formed by the highest and lowest price levels during this period of lower volatility. Use tools like horizontal lines on your trading platform (e.g., MetaTrader 4/5 or TradingView) to mark these levels clearly.

Place pending orders above and below the range

Once the range is identified, set pending buy stop and sell stop orders just above the resistance level and below the support level. This ensures that your trades are triggered automatically when the price breaks out of the range, reducing the risk of missing opportunities in a fast-moving market.

Set take profit (TP) and stop loss (SL) levels

Risk management is essential. Use a risk-to-reward ratio of at least 1:2 to define your take profit and stop-loss levels. Tools like the Average True Range (ATR) indicator can help you set realistic targets based on current market volatility.

Monitor and adjust during the New York session

Once trades are live, monitor the market closely for unexpected reversals or news-driven price movements. Be prepared to adjust your stop loss to protect profits as the trade progresses.

Key indicators and tools to enhance the New York session breakout strategy

Using the right indicators and tools can significantly improve the success rate of the New York breakout strategy by providing additional confirmation for breakout setups and optimizing trade execution.

Moving averages

Moving averages, such as the 50-period and 200-period exponential moving averages (EMAs), can help confirm the direction of the trend. If price breaks out above a pre-market range and is already trading above a rising moving average, it adds confluence to the trade, signaling potential strength in the breakout.

Bollinger bands

Bollinger Bands measure volatility and help identify periods of low activity that precede breakouts. If price consolidates near the middle of the bands before breaking out, it often indicates a stronger potential for price movement in the direction of the breakout.

Average True Range (ATR)

The ATR is a vital tool for setting realistic stop-loss and take-profit levels. By measuring market volatility, it ensures your targets are neither too conservative nor overly ambitious, increasing the likelihood of successful trades.

Pivot points

Pivot points are commonly used to identify intraday support and resistance levels. When a breakout aligns with a pivot point, it can serve as a confirmation of the price’s momentum.

Economic calendars

Tools like Forex Factory or DailyFX provide schedules for economic news releases. Avoid entering trades during high-impact events to minimize the risk of false breakouts caused by unpredictable price swings.

Advantages of the New York breakout forex trading strategy

The New York breakout forex trading strategy offers several advantages that make it an attractive choice for traders seeking to capitalize on the forex market’s dynamic movements.

High liquidity and volatility

The New York session is characterized by high trading volume, especially during its overlap with the London session. This increased activity often leads to significant price movements, providing traders with ample opportunities to capture profitable breakouts. Currency pairs involving the U.S. dollar, such as EUR/USD, GBP/USD, and USD/JPY, are particularly responsive during this time.

Clear entry and exit points

By focusing on pre-market consolidation ranges and identifying support and resistance levels, the New York breakout strategy provides clear entry and exit points. This simplicity makes it an excellent choice for traders who prefer structured approaches to trading.

Opportunities for quick profits

Due to the sharp price movements that often accompany breakouts, traders can potentially achieve quick profits within a relatively short timeframe. This makes the strategy appealing to day traders and scalpers who aim to capitalize on intraday market trends.

Compatibility with technical tools

The strategy pairs well with popular technical indicators like Bollinger Bands, moving averages, and pivot points, allowing traders to enhance their setups and confirm breakout signals.

Risks of using the New York session breakout strategy

While the New York breakout strategy can be a profitable trading approach, it is not without challenges and risks.

False breakouts

One of the most common risks associated with breakout strategies is false breakouts. These occur when the price momentarily moves beyond a support or resistance level, only to reverse back into the consolidation range. False breakouts can lead to premature trade entries, resulting in losses if stop-loss levels are not effectively placed.

Impact of news events

The New York session is heavily influenced by major U.S. economic news releases, such as Federal Reserve decisions, non-farm payrolls, and GDP data. These events can cause sharp and unpredictable price movements that may invalidate pre-market ranges or create sudden reversals. Traders must consult an economic calendar to avoid placing trades during high-impact news periods.

Over-leveraging

The promise of significant profits during the New York session’s volatility can tempt traders to over-leverage their positions. However, excessive leverage increases exposure to market fluctuations and can lead to substantial losses if trades move against expectations.

Conclusion

The New York breakout strategy offers traders a structured and effective way to capitalize on the high volatility and liquidity of one of the forex market’s most active trading sessions. Rooted in the principles of momentum trading, this strategy is particularly suited for traders seeking to take advantage of sharp price movements during the New York session, which often coincides with significant economic events and strong market activity.

The success of this strategy depends on thorough preparation and disciplined execution. Identifying the pre-market consolidation range, placing pending orders at key support and resistance levels, and managing risk with carefully set stop-loss and take-profit orders are all essential components of effective trading. By integrating technical tools such as moving averages, Bollinger Bands, and pivot points, traders can enhance their analysis and increase the probability of successful breakout trades.

However, traders must also be aware of the risks associated with this approach, including false breakouts, the impact of news events, and the emotional pressure of trading in a high-volatility environment. Developing and adhering to a well-defined trading plan, practicing on demo accounts, and keeping a detailed trading journal can help mitigate these challenges and build consistency over time.