Momentum scalping strategy

Momentum scalping thrives on the principle that strong price movements tend to continue for a short period before reversing. By identifying these brief windows of opportunity, traders can enter and exit positions quickly, minimizing exposure to market volatility while aiming for high-frequency, low-margin gains. This strategy is particularly popular among day traders and scalpers who prefer fast-paced environments and have the ability to monitor the markets continuously.

The forex market’s high liquidity and 24-hour accessibility make it an ideal environment for momentum scalping. However, success with this strategy requires a solid understanding of technical indicators, sharp decision-making skills, and disciplined risk management.

Understanding momentum in forex trading

Momentum in forex trading refers to the strength and speed of price movements over a specific period. It reflects how quickly prices are rising or falling, indicating the level of interest or conviction among traders in a particular currency pair. Unlike trend-following strategies that focus on the direction of the market, momentum trading emphasizes the velocity of price changes, aiming to capitalize on sharp, short-term moves.

At its core, momentum is driven by market psychology—when traders collectively react to news events, economic data releases, or shifts in sentiment, it can trigger rapid price movements. Understanding this behaviour is crucial for momentum scalpers, as it helps identify when a currency pair is gaining or losing strength.

Several technical indicators are commonly used to measure momentum:

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions, signalling potential reversals or continuation of price moves.

- Moving Average Convergence Divergence (MACD): Highlights changes in momentum through the relationship between moving averages.

- Stochastic Oscillator: Compares a currency’s closing price to its price range over a specific period, detecting potential trend reversals.

- Commodity Channel Index (CCI): Measures the deviation of price from its average, helping to spot emerging trends.

Core principles of a momentum scalping strategy

The momentum scalping strategy revolves around capturing small price movements driven by strong, short-term market momentum. To apply this strategy effectively, traders need to understand its core principles, which focus on speed, precision, and disciplined risk management.

One of the key principles is identifying strong price movements. Momentum scalpers look for currency pairs showing rapid price acceleration, often triggered by high-impact economic events, market sentiment shifts, or technical breakouts. Recognizing these movements early allows traders to enter positions before the momentum fades.

Another critical factor is the reliance on high-frequency trading and quick decision-making. Since scalping involves opening and closing trades within minutes, traders must act decisively based on technical signals without hesitation. This approach requires a deep familiarity with trading platforms like MetaTrader 4/5 or TradingView, where execution speed can significantly impact profitability.

Momentum scalping typically focuses on low timeframes, such as 1-minute or 5-minute charts. These short intervals help traders spot quick price fluctuations and capitalize on small gains multiple times throughout the trading session.

Market sentiment also plays a significant role. Sudden shifts in investor confidence—due to geopolitical events, economic reports, or central bank announcements—can create powerful momentum surges. Scalpers need to stay informed and responsive to these developments.

Setting up for momentum scalping

Successful implementation of a momentum scalping strategy starts with the right setup, combining efficient tools, optimal market conditions, and strategic planning. Since scalping relies on speed and precision, having the proper infrastructure is crucial to capitalize on short-term price movements.

Choosing the right trading platform is the first step. Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView are popular among scalpers due to their advanced charting tools, customizable indicators, and fast execution speeds. Low-latency performance is critical, as even slight delays can impact trade outcomes in fast-speeding markets.

Next, selecting the appropriate currency pairs is essential. Scalpers typically focus on major pairs such as EUR/USD, GBP/USD, and USD/JPY because they offer high liquidity and tight spreads. Low transaction costs are vital since scalping involves frequent trades, and wider spreads can erode profits.

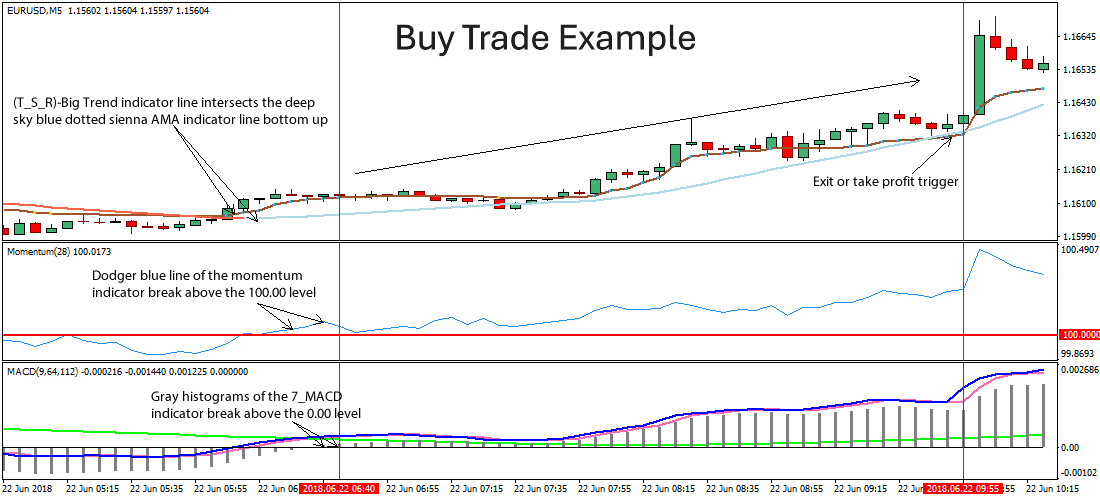

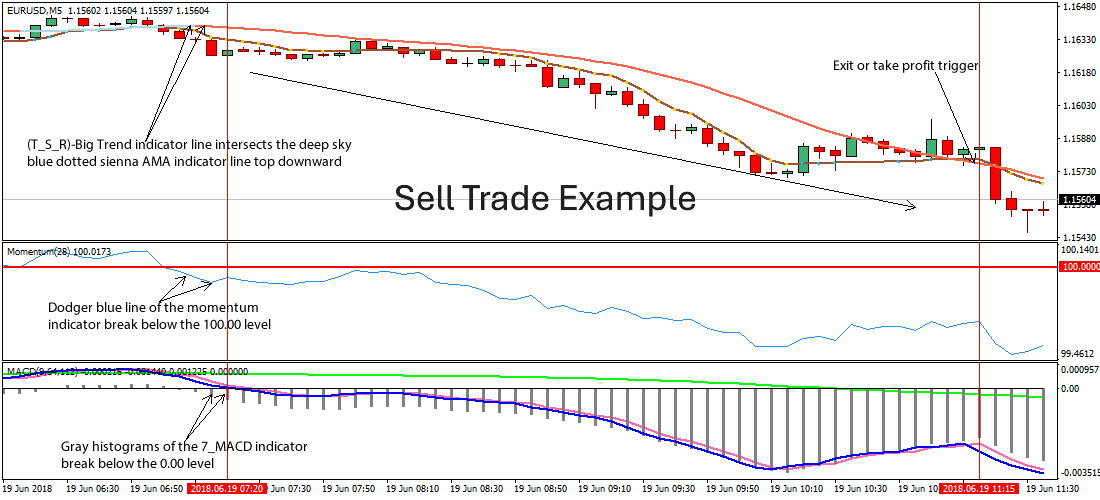

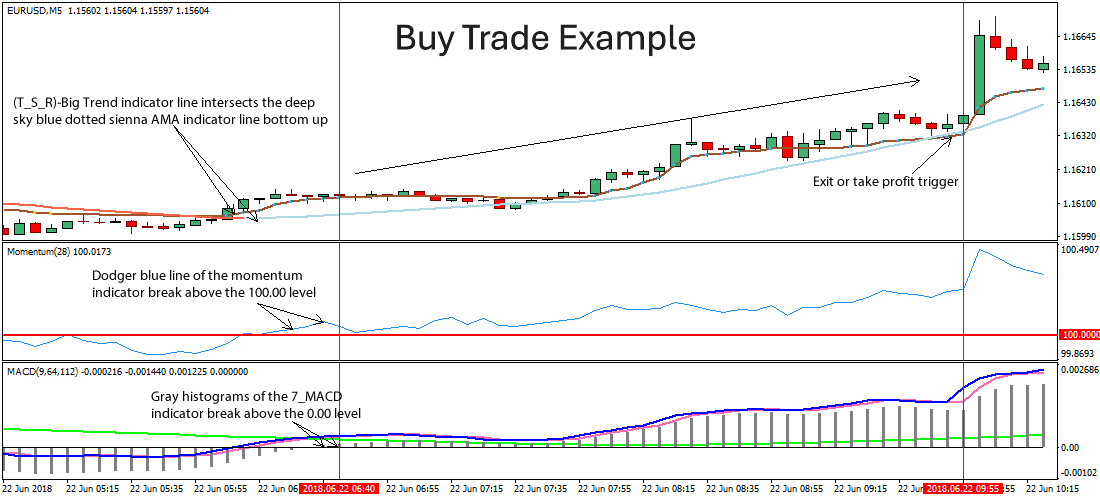

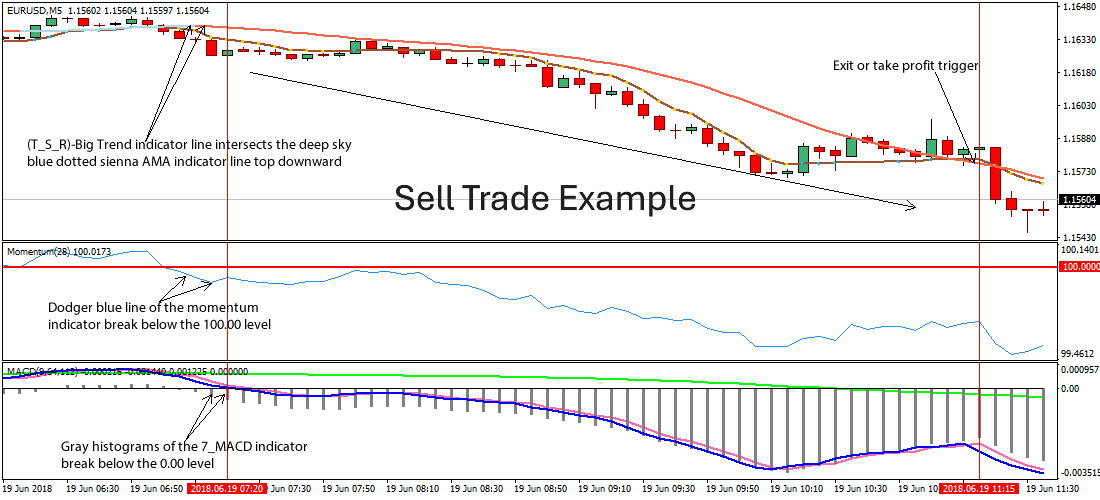

When it comes to timeframes, momentum scalping works best on 1-minute (M1) and 5-minute (M5) charts. These shorter intervals provide real-time insights into rapid price fluctuations, allowing traders to react quickly to momentum shifts.

Additionally, incorporating technical analysis tools enhances decision-making. Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands help identify entry and exit points based on momentum signals.

Lastly, understanding the best market conditions for scalping is key. High-volatility periods—such as during major economic releases (e.g., Non-Farm Payrolls, FOMC announcements) or overlapping trading sessions (London-New York)—provide ideal environments for capturing quick price movements efficiently.

Step-by-step guide to implementing a momentum scalping trading strategy

Implementing a momentum scalping trading strategy requires a structured approach to identify, execute, and manage trades effectively.

Step 1: Analyzing market conditions

Begin by assessing overall market conditions. High volatility and strong liquidity are key for momentum scalping. Focus on major trading sessions like the London and New York overlaps, or during major economic events (e.g., Federal Reserve announcements, ECB policy decisions). Use economic calendars from trusted sources like Forex Factory or DailyFX to anticipate market-moving events.

Step 2: Identifying entry signals using momentum indicators

Apply technical indicators to spot potential trade setups. Indicators like the Relative Strength Index (RSI) help identify overbought or oversold conditions, while the MACD highlights momentum shifts through moving average crossovers. Look for confirmation signals, such as price breaking above resistance or below support with increased volume.

Step 3: Setting stop-loss and take-profit levels

Risk management is crucial. Set tight stop-loss orders to limit potential losses, typically just a few pips away from the entry point. For take-profit targets, aim for small, consistent gains—often a 1:1 or slightly better risk-reward ratio suits scalping strategies.

Step 4: Executing trades with precision

Execute trades quickly using platforms optimized for speed, like MetaTrader 4/5. Ensure low-latency connections to reduce slippage, especially during volatile conditions.

Step 5: Monitoring trades and adjusting positions rapidly

Stay alert and monitor trades closely. Momentum can shift rapidly, so be prepared to adjust stop-loss levels or exit positions manually if the market reverses unexpectedly. This agility is key to maximizing gains and minimizing losses.

Effective risk management techniques for scalping momentum trading

Unlike longer-term trading strategies, scalping involves frequent trades with small profit margins, making disciplined risk management essential for long-term success.

Managing leverage and position sizing

High leverage can amplify profits but also increases the risk of substantial losses. While many brokers offer leverage ratios up to 1:500, it’s advisable to use leverage cautiously. Implementing proper position sizing based on account balance and risk tolerance helps ensure that no single trade jeopardizes the overall portfolio.

Importance of tight stop-loss orders

Given the quick market fluctuations in scalping, setting tight stop-loss orders is a fundamental risk control measure. A stop-loss limits potential losses by automatically closing a position when the price moves against the trade beyond a predetermined level. Scalpers typically place stop-loss orders just a few pips away from the entry point.

Maintaining a favourable risk-reward ratio

Although scalping often targets small profits, maintaining at least a 1:1 risk-reward ratio is advisable. This means the potential reward equals the risk, ensuring that consistent wins can offset occasional losses.

Dealing with slippage and spread costs

Frequent trading exposes scalpers to slippage and spread costs, which can erode profits. To mitigate this, trade during periods of high liquidity, such as major market sessions, and choose brokers offering low spreads and fast execution speeds.

Common mistakes to avoid in momentum scalping

While the momentum scalping strategy offers opportunities for quick profits, it also comes with unique challenges. Many traders, especially beginners, fall into common traps that can undermine their success.

Overtrading and chasing the market

One of the most frequent mistakes is overtrading—entering too many trades in a short period without solid setups. The fast pace of scalping can create a sense of urgency, leading traders to chase the market based on fear of missing out (FOMO). This behavior often results in poorly planned trades and unnecessary losses. Maintaining discipline and sticking to predefined trading criteria is essential.

Ignoring market news and economic events

Momentum scalpers sometimes rely solely on technical indicators, overlooking the impact of major economic events. High-impact announcements, such as Non-Farm Payrolls (NFP), central bank decisions, or inflation data, can cause extreme volatility. Trading during such periods without awareness of the underlying news can expose traders to unexpected price swings. Using economic calendars from platforms like Forex Factory helps stay informed.

Poor execution speed and platform latency

In scalping, even milliseconds matter. Slow trade execution or platform latency can result in slippage, where trades are filled at less favorable prices. To mitigate this, traders should use fast, reliable trading platforms like MetaTrader 4/5 and ensure a stable internet connection.

Neglecting risk management

Failing to implement strict risk management rules, such as using stop-loss orders or proper position sizing, can quickly erode trading capital. Scalping’s small profit margins mean that even a few uncontrolled losses can outweigh gains.

Conclusion

The momentum scalping strategy is a dynamic approach that offers traders the potential to capitalize on short-term price movements in the forex market. By focusing on quick trades driven by strong momentum, scalpers aim to accumulate small but consistent profits throughout the trading session. This strategy thrives in highly liquid environments, particularly during major market sessions and economic events that trigger sharp price fluctuations.

However, momentum scalping is not suitable for everyone. It requires constant market monitoring, quick decision-making, and the ability to handle the psychological stress associated with high-frequency trading. Successful momentum scalping relies heavily on effective risk management techniques, such as using tight stop-loss orders, managing leverage wisely, and maintaining strict trading discipline to minimize emotional decision-making.