How to read forex economic calendar

A forex economic calendar is a tool used by traders to track and monitor economic events, announcements, and data releases that have the potential to impact the foreign exchange market. This calendar compiles a comprehensive list of scheduled economic events from around the world, including government reports, central bank announcements, and other financial indicators. Each event is accompanied by key details, such as the event name, description, previous, forecast, and actual values, and an importance rating. It serves as a valuable resource for traders to stay informed about upcoming market-moving events.

Understanding a forex economic calendar is crucial for forex traders because it enables them to make informed trading decisions. Economic events can have a significant impact on currency exchange rates, leading to price fluctuations and potential trading opportunities. Traders who are aware of these events and their potential consequences can better manage risk and seize profitable moments in the market. By tracking economic indicators and market sentiment through the calendar, traders gain a competitive edge and can adapt their strategies accordingly.

Components of a forex economic calendar

Event listings

Economic indicators

A forex economic calendar primarily comprises a list of economic indicators. These indicators are measurements or statistics that reflect the economic health and performance of a country or region. They include key data points such as Gross Domestic Product (GDP), Consumer Price Index (CPI), unemployment rate, and interest rates. Each indicator has its significance in assessing economic conditions, and traders closely monitor them to anticipate currency market movements.

Market impact ratings

Events listed on a forex economic calendar are assigned market impact ratings. These ratings categorize events as high, medium, or low impact based on their potential to influence currency prices. High-impact events are typically major economic releases and central bank announcements, while low-impact events may include less significant data releases. Traders pay special attention to high-impact events as they often lead to substantial market volatility and trading opportunities.

Previous, forecast, and actual values

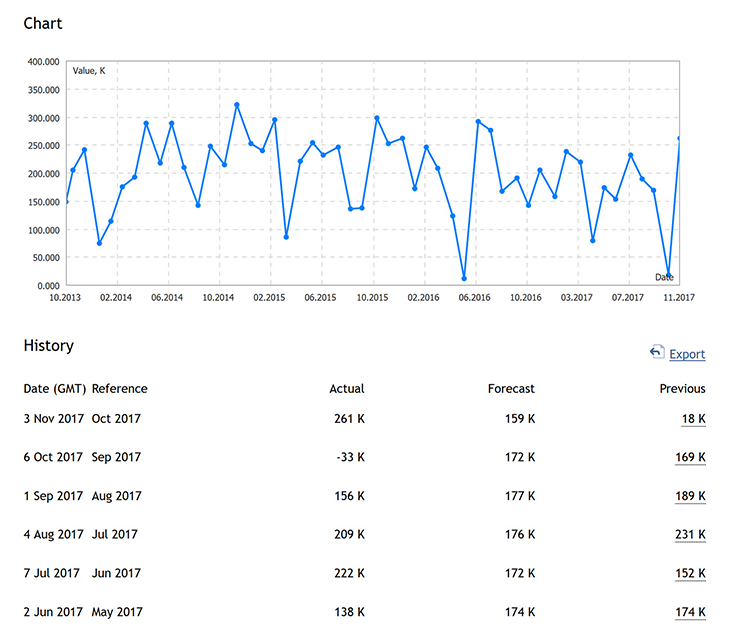

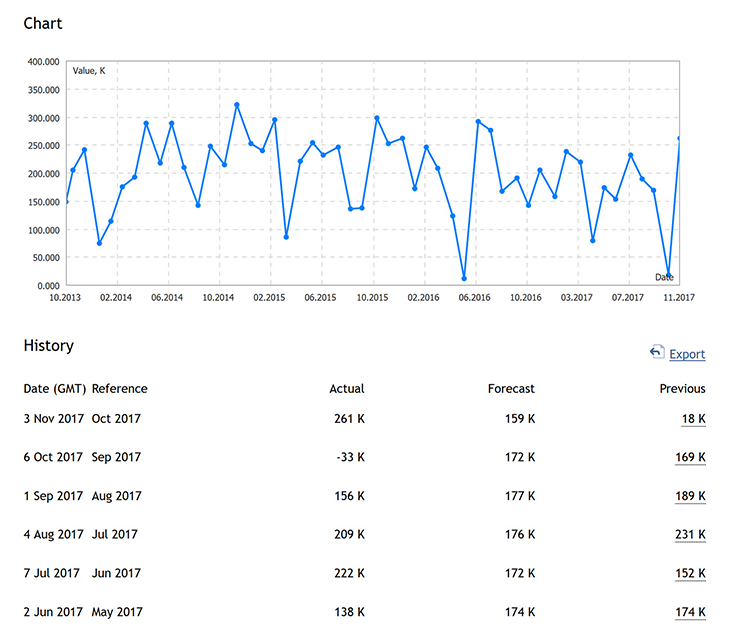

To help traders analyze the impact of an economic event, the calendar provides key data points such as previous, forecast, and actual values. The previous value represents the indicator's measurement in the previous reporting period, the forecast value is the expected result for the current release, and the actual value is the reported result. Comparing these values allows traders to assess whether an event has met, exceeded, or fallen short of expectations, which can significantly influence market sentiment.

Filters and customization options

Date and time filters

Forex economic calendars offer date and time filters, allowing traders to narrow down their focus to specific time frames. This feature is especially useful for traders who want to plan their activities around upcoming events or who trade during specific market sessions.

Country and currency filters

Traders can filter events by country and currency pair, tailoring the calendar to their trading preferences. This customization option ensures that traders receive information relevant to the currencies they are actively trading.

Importance filters

The importance filter categorizes events by their significance, making it easy for traders to identify high-impact events that are likely to have a substantial influence on the forex market. This feature aids traders in prioritizing their attention and resources.

Interpreting economic indicators

Major economic indicators

GDP (Gross Domestic Product)

Gross Domestic Product is one of the most critical economic indicators. It measures the total value of goods and services produced within a country's borders over a specific period. A rising GDP typically signifies economic growth and can lead to a stronger currency. Conversely, a declining GDP may signal economic contraction and can weaken a currency.

CPI (Consumer Price Index)

The Consumer Price Index reflects changes in the average prices paid by consumers for a basket of goods and services. Rising CPI indicates inflation, which can erode the purchasing power of a currency. Central banks often use CPI data to guide monetary policy decisions.

Unemployment rate

The unemployment rate measures the percentage of the workforce that is unemployed and actively seeking employment. A lower unemployment rate is generally positive for a currency, as it suggests a robust job market and potential wage growth.

Interest rates

Interest rates set by a country's central bank play a crucial role in forex markets. Higher interest rates can attract foreign capital seeking better returns, which can strengthen a currency. Conversely, lower interest rates can have the opposite effect.

Minor economic indicators

Retail sales

Retail sales data reflects consumer spending patterns. An increase in retail sales can indicate strong consumer confidence and economic growth, potentially strengthening a currency.

Manufacturing PMI (Purchasing Managers' Index)

The Manufacturing PMI measures the health of a country's manufacturing sector. Values above 50 indicate expansion, while values below 50 indicate contraction. A robust manufacturing sector can boost employment and economic activity, positively impacting a currency.

Consumer confidence

Consumer confidence surveys gauge the optimism or pessimism of consumers regarding the economy. High consumer confidence can lead to increased spending and economic growth, which can strengthen a currency.

Trade balance

The trade balance represents the difference between a country's exports and imports. A trade surplus (more exports than imports) can lead to currency appreciation, while a trade deficit (more imports than exports) can weaken a currency.

Understanding how these economic indicators impact currency markets is essential for forex traders. Monitoring these indicators and their releases on the economic calendar can provide valuable insights into potential currency movements, aiding traders in making informed trading decisions.

Understanding market impact ratings

In the realm of forex trading, not all economic events carry equal weight. Market Impact Ratings, often denoted as high, medium, or low impact, are a crucial aspect of a forex economic calendar. These ratings serve as a guideline for traders, helping them assess the potential influence of specific events on currency pairs.

High impact events

High impact events are typically major economic releases, central bank announcements, or geopolitical developments that have the potential to significantly impact currency markets. Traders tend to be more cautious and attentive during these events, as they can lead to substantial market volatility and rapid price movements.

Medium impact events

Medium impact events are important but not as likely to cause extreme market fluctuations as high-impact events. These events may include lesser-known economic indicators or reports from smaller economies. While they can still influence currency pairs, their effects are generally more moderate.

Low impact events

Low impact events are usually routine economic releases with limited potential to disrupt the market. These events are often overshadowed by high or medium impact counterparts and may only cause minor fluctuations in currency prices.

Traders pay close attention to market impact ratings to tailor their trading strategies accordingly. During high impact events, traders may choose to reduce their position sizes or implement risk management strategies to mitigate potential losses due to increased market volatility. Conversely, during low impact events, traders may opt for more relaxed trading approaches.

One valuable aspect of understanding market impact ratings is the ability to analyze historical market reactions to similar events. Traders can use this information to anticipate how currency pairs might behave when specific economic data is released. This historical perspective can assist traders in making well-informed decisions and managing risk effectively when trading forex.

Reading the forex economic calendar

Event name and description

To effectively utilize a Forex economic calendar, traders must start by identifying specific events of interest. Each event listed on the calendar is accompanied by a name and description that provides insight into what the event entails. Understanding the event's context and relevance is crucial for informed trading decisions.

Importance level

Market Impact Ratings categorize events into high, medium, and low importance levels. Traders should consider the importance level when gauging the potential impact on currency pairs. High-impact events demand heightened attention due to their capacity to drive significant market movements.

Previous, forecast, and actual values

The forex economic calendar displays key numerical data for each event, including the previous, forecast, and actual values. Traders compare these values to assess whether an event has met, exceeded, or fallen short of expectations. Discrepancies between forecast and actual values can trigger market reactions.

Market reaction

Past market reactions to similar events provide valuable insights. Traders often look at historical price movements to anticipate how currency pairs might respond to the current event. These insights can guide entry and exit points or help traders manage risk.

Using the calendar for trading decisions

Short-term vs. long-term trading

Traders must tailor their approach to their trading horizon. Short-term traders may capitalize on immediate price fluctuations following high-impact events, while long-term traders could use economic calendar data to validate their broader market outlook.

Trading strategies based on economic calendar

The forex economic calendar plays a pivotal role in various trading strategies. For instance, a trader might adopt a news-based strategy, focusing on high-impact events to make quick profits. Alternatively, a trend-following strategy could involve considering economic data as part of a broader market analysis.

Incorporating the forex economic calendar into trading practices allows traders to make informed decisions, manage risk effectively, and adapt strategies to changing market conditions. By mastering event analysis and aligning trading choices with economic calendar insights, traders can enhance their potential for success in the forex market.

Tips for effective use of the forex economic calendar

Staying informed about economic events is essential for successful forex trading. Regularly check the forex economic calendar to ensure you are aware of upcoming events and their potential impact on currency pairs. Many financial news websites and trading platforms also offer real-time event updates and analysis, helping you stay ahead of the curve.

Setting up alerts for high-impact events can be a game-changer. Most trading platforms allow you to configure notifications for specific economic releases, ensuring you don't miss crucial updates. These alerts can be especially valuable for traders who cannot monitor the calendar around the clock.

Maintaining a trading journal is a fundamental practice for any trader, and it becomes even more critical when using the forex economic calendar. Record your reactions to economic events, the strategies you employed, and the outcomes. Over time, this journal can help you identify patterns in your trading behavior and refine your approach.

Conclusion

The forex market is dynamic, and economic conditions are constantly evolving. To thrive in this environment, commit to continual learning. Study the historical reactions of currency pairs to economic events, read economic analyses, and stay updated on global financial news. Continual learning will help you adapt to changing market conditions and refine your trading strategies.

The forex economic calendar is a powerful tool that can significantly enhance your trading prowess. Whether you're a novice or an experienced trader, its insights into economic events and market sentiment are invaluable. By mastering event analysis, utilizing historical data, and integrating the calendar into your trading routine, you can navigate the dynamic world of forex trading with greater confidence and success. Remember, success in forex trading is an ongoing journey, and the forex economic calendar is your trusted companion along the way.