Heiken Ashi strategy

The Heiken Ashi strategy is handy, catering to different trading styles—from long-term trend following to short-term scalping. Unlike traditional candlestick charts that display price movements based on individual time periods, Heiken Ashi charts modify the way candlesticks are formed. This smoothing effect makes it easier for traders to identify the direction and strength of a trend, reducing the confusion often caused by short-term volatility. As a result, Heiken Ashi is particularly useful for spotting trend continuations, reversals, and consolidations with greater clarity.

Understanding Heiken Ashi candlesticks

To effectively apply the Heiken Ashi strategy in forex trading, it’s essential to understand how Heiken Ashi candlesticks differ from traditional candlestick charts. While standard candlesticks display price movements based on the open, high, low, and close of each time period, Heiken Ashi modifies this data to create a smoother visual representation of trends.

Calculation formula

The term Heiken Ashi means "average bar" in Japanese, reflecting its method of averaging price data. The formula for calculating Heiken Ashi candles is as follows:

- Open = (Previous Heiken Ashi Open + Previous Heiken Ashi Close) ÷ 2

- Close = (Open + High + Low + Close) ÷ 4

- High = The highest value among the current period’s high, Heiken Ashi open, and close

- Low = The lowest value among the current period’s low, Heiken Ashi open, and close

This calculation method smooths out price fluctuations, making it easier to identify trends and reversals.

Visual differences

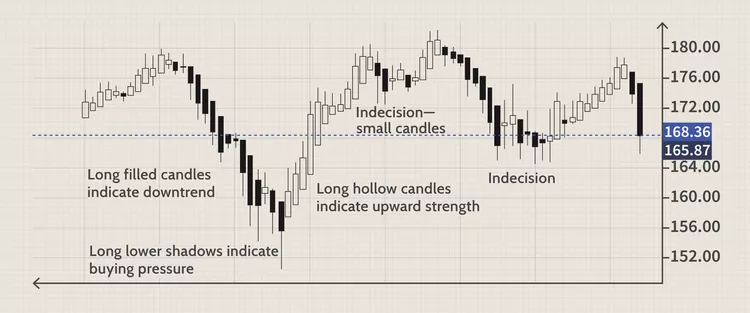

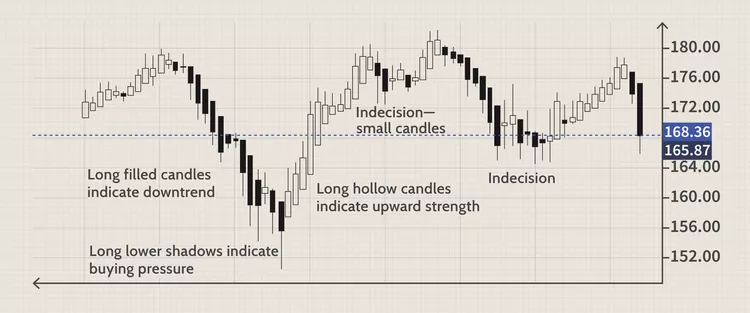

Heiken Ashi candles often appear more uniform compared to traditional candlesticks. For example, during strong uptrends, candles are typically larger, green (or white), and lack lower wicks, indicating sustained bullish momentum. Conversely, downtrends show consistent red (or black) candles with minimal upper wicks.

Benefits of using Heiken Ashi

Traders favour Heiken Ashi for its ability to:

- Highlight clear trend directions

- Reduce market noise

- Assist in identifying potential reversals with greater accuracy

Core principles of the Heiken Ashi strategy

The effectiveness of the Heiken Ashi strategy lies in its ability to simplify trend analysis, making it easier for traders to identify market direction, potential reversals, and optimal entry and exit points. Understanding these core principles is crucial for applying Heiken Ashi techniques effectively in forex trading.

Trend identification

One of the primary strengths of Heiken Ashi is its ability to highlight clear trends. In an uptrend, Heiken Ashi candles typically appear as consecutive bullish candles with large bodies and little to no lower wicks. This consistency indicates strong buying pressure. Conversely, a downtrend is characterized by a series of bearish candles with long bodies and minimal upper wicks, reflecting sustained selling momentum. Recognizing these patterns helps traders avoid false signals often seen with traditional candlesticks during volatile periods.

Reversal patterns

Identifying trend reversals is another key aspect of the Heiken Ashi strategy. Reversal signals often appear as candles with small bodies and long wicks on both ends, resembling doji-like formations. This pattern suggests market indecision and potential exhaustion of the current trend. A shift from consecutive bullish candles to such indecisive candles can signal an upcoming bearish reversal, and vice versa.

Entry and exit signals

Traders use Heiken Ashi to time their trades effectively. Entry signals are typically based on the appearance of strong trend candles after a reversal pattern, while exit signals may be triggered when candles start showing signs of weakening momentum, such as shrinking bodies or the emergence of wicks against the trend direction.

Popular Heiken Ashi trading strategies

The versatility of the Heiken Ashi strategy makes it suitable for a wide range of trading styles, from long-term trend following to short-term scalping. By combining Heiken Ashi candles with other technical tools, traders can develop robust strategies that enhance market analysis and improve trade accuracy.

Heikin Ashi trend following strategy

This strategy focuses on capturing sustained price movements. Traders look for consecutive Heiken Ashi candles of the same colour with minimal wicks against the trend, indicating strong momentum. To confirm trends, traders often combine Heiken Ashi with moving averages, such as the 50-day or 200-day EMA, to filter out false signals. This approach works well in trending markets, helping traders stay in profitable trades longer.

Heikin Ashi Scalping strategy

For those seeking quick profits in volatile conditions, the Heikin Ashi scalping strategy offers an effective solution. Scalpers use short timeframes (e.g., 1-minute or 5-minute charts) to identify micro trends. Pairing Heiken Ashi with oscillators like the RSI or Stochastic Indicator can help confirm overbought or oversold conditions, enhancing entry and exit precision.

Heikin Ashi candle strategy

This approach relies solely on Heiken Ashi candlestick patterns without additional indicators. Traders watch for specific formations, such as small-bodied candles with long wicks, signalling potential reversals. This minimalist strategy emphasizes pure price action analysis.

Combining Heiken Ashi with technical indicators

Many traders integrate Heiken Ashi with indicators like MACD, Bollinger Bands, or Fibonacci retracements to strengthen trading signals. This combination helps validate trend strength, identify potential entry points, and manage risks effectively.

Heiken Ashi scalping strategy in detail

The Heiken Ashi scalping strategy is designed for traders looking to capitalize on small, rapid price movements within short timeframes. Scalping requires quick decision-making, and Heiken Ashi candlesticks help by filtering out market noise, making short-term trends more visible and easier to follow.

Scalping mechanics

Heiken Ashi smooths out price fluctuations, allowing scalpers to identify micro trends more clearly than with traditional candlesticks. Traders typically use 1-minute to 5-minute charts to spot quick trend shifts. Consecutive bullish (green) candles with no lower wicks indicate strong upward momentum, while bearish (red) candles without upper wicks suggest a robust downtrend. This clarity helps scalpers enter and exit trades with greater precision.

Ideal currency pairs and timeframes

Scalping with Heiken Ashi is most effective in highly liquid forex pairs such as EUR/USD, GBP/USD, and USD/JPY, where tight spreads and consistent volatility support rapid trade execution. Traders often prefer sessions with high market activity, like the London or New York sessions, to maximize opportunities.

Risk management in scalping

Effective risk management is crucial due to the high frequency of trades. Scalpers typically set tight stop-loss orders just beyond recent swing highs or lows to limit losses. Take-profit levels are often modest, aiming for quick gains while minimizing exposure to sudden market shifts.

Case study

Consider a EUR/USD trade during the London session. A series of strong bullish Heiken Ashi candles without lower wicks signals an entry point. The trade is exited as soon as a candle with a small body or a lower wick forms, indicating potential trend weakening.

Pros and cons of using Heiken Ashi strategies

Advantages

One of the key benefits of using Heiken Ashi is its ability to simplify trend analysis. By smoothing out price fluctuations, Heiken Ashi makes it easier to identify the direction and strength of a trend without the distraction of short-term volatility. This clarity is particularly useful for trend-following strategies, helping traders stay in profitable trades longer by avoiding premature exits.

Another advantage is the reduction of market noise, which minimizes false signals common in highly volatile markets. This makes Heiken Ashi especially effective when combined with technical indicators like moving averages or RSI, providing more reliable entry and exit points. Additionally, its visual simplicity helps reduce emotional trading, as traders can rely on consistent patterns rather than reacting impulsively to erratic price movements.

Disadvantages

Despite its benefits, Heiken Ashi has limitations. The most notable drawback is its lagging nature. Since Heiken Ashi candles are based on averaged price data, they tend to react slower to real-time price changes. This lag can delay signals, making it less suitable for strategies that require quick decision-making, such as breakout or news-based trading.

Moreover, Heiken Ashi may obscure precise price levels, as the modified open, close, high, and low differ from actual market prices. This can be problematic for traders who rely on exact price points for stop-loss or take-profit placements.

Comparison with traditional candlestick strategies

While traditional candlesticks offer real-time price data and are more reactive to sudden market changes, Heiken Ashi provides a smoother, trend-focused view. Traders often use both in combination—traditional candlesticks for detailed price action and Heiken Ashi for overall trend clarity.

Conclusion

The Heiken Ashi strategy offers a powerful approach to forex trading by simplifying trend analysis and reducing market noise. Unlike traditional candlestick charts, Heiken Ashi provides a smoother, more consistent view of price movements, making it easier for traders to identify trends, spot potential reversals, and make informed trading decisions. Its versatility allows it to be applied effectively across various trading styles, from long-term trend following to short-term scalping.

One of the key strengths of Heiken Ashi lies in its ability to highlight clear trend directions, helping traders stay in profitable positions longer and avoid premature exits caused by short-term volatility. When combined with technical indicators like moving averages, RSI, or MACD, the strategy’s reliability increases, offering traders more robust confirmation signals.

However, it’s important to recognize the limitations of Heiken Ashi. Its lagging nature can delay reaction to sudden market changes, which may not be ideal for breakout or news-driven trading strategies. Therefore, integrating Heiken Ashi with traditional price action analysis and proper risk management techniques is essential for optimal results.