Donchian channel strategy

The Donchian Channel strategy has emerged as a popular tool among forex traders, offering a structured approach to analyzing market trends and identifying potential trade opportunities. Its simplicity and adaptability have made it a staple in the toolbox of both novice and experienced traders.

Forex trading, known for its dynamic and often unpredictable nature, requires traders to rely on well-researched strategies to navigate market volatility effectively. The Donchian Channel trading strategy provides a disciplined framework for decision-making by highlighting key price levels that signal potential entry and exit points. Traders can employ this system to capture trends, manage risk, and achieve consistency in their trading activities.

What are Donchian channels?

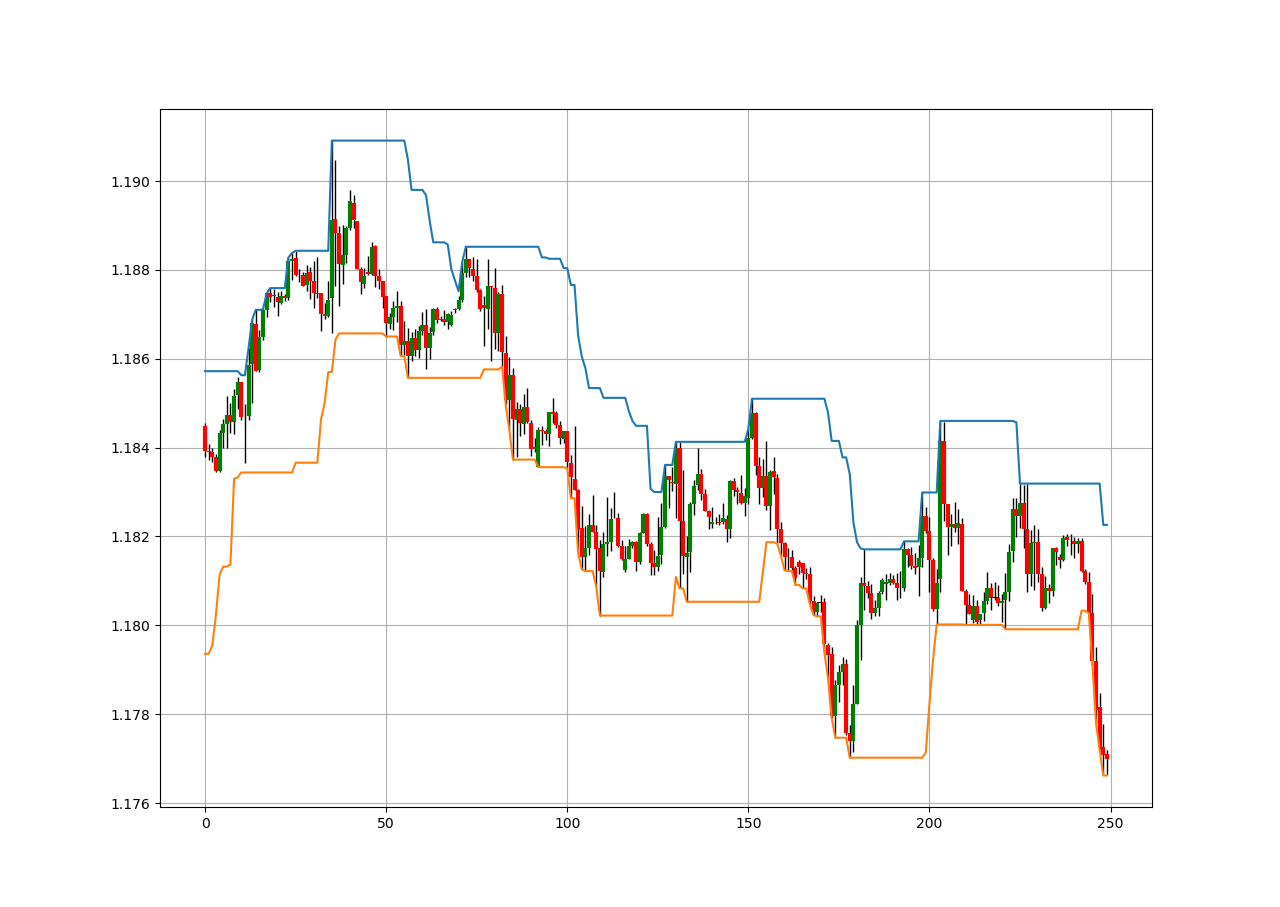

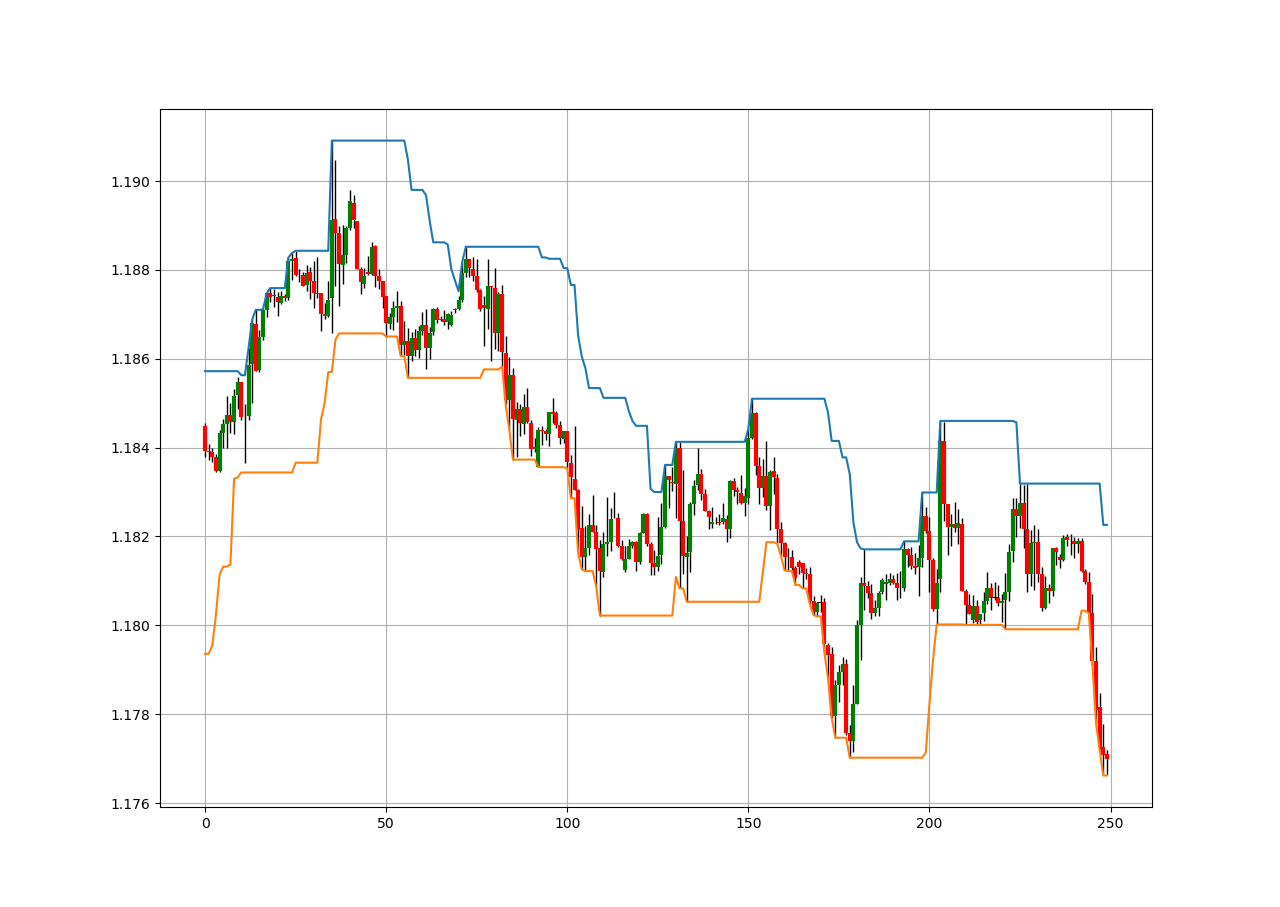

Donchian Channels are a widely-used technical analysis tool designed to help traders identify price trends and potential breakout points in financial markets, including forex. Named after Richard Donchian, a pioneer of systematic trading, these channels consist of three lines that form a dynamic boundary around price action.

The upper line represents the highest price over a specified time period, while the lower line marks the lowest price during the same period. The middle line, often calculated as the average of the upper and lower bands, serves as a reference point for trend direction. This simplicity makes Donchian Channels an accessible tool for traders at all levels.

Donchian Channels are particularly valuable in forex trading, where rapid price fluctuations are common. By highlighting key support and resistance levels, they help traders anticipate potential breakout zones and trend reversals. For instance, when the price breaks above the upper channel, it may signal a bullish trend, while a break below the lower channel could indicate a bearish trend.

Unlike similar tools such as Bollinger Bands, which incorporate volatility in their calculation, Donchian Channels focus solely on historical highs and lows. This gives them a unique advantage for traders who prefer a straightforward approach.

How the Donchian channel strategy works

The Donchian Channel strategy is a systematic approach that uses price channel boundaries to identify trading opportunities in trending markets. At its core, the strategy tracks price movements to detect breakouts above or below a predefined range, signaling potential entry or exit points.

The upper and lower bands of the Donchian Channel are calculated based on the highest high and lowest low over a specified period, such as 20 days. These levels act as dynamic support and resistance lines. A breakout occurs when the price moves beyond these boundaries, suggesting the start of a new trend. For instance, a price closing above the upper band may indicate a bullish breakout, while a move below the lower band signals a bearish trend.

Traders often use the Donchian Channel strategy in conjunction with other indicators to validate signals. For example, pairing it with the Relative Strength Index (RSI) can help determine if a breakout aligns with overbought or oversold conditions, improving the strategy's reliability.

One of the key advantages of this strategy is its objectivity. By providing clear entry and exit points, it minimizes emotional decision-making, a common pitfall in trading. Additionally, the strategy adapts to various market conditions and timeframes, from scalping on hourly charts to swing trading over weeks.

Advantages of using the Donchian channel strategy in forex trading

The Donchian Channel strategy offers several advantages that make it a powerful tool for forex traders. Its ability to simplify trend analysis and identify breakout opportunities contributes to its widespread use among market participants.

One of the key benefits of this strategy is its versatility. Donchian Channels can be applied across different timeframes, making them suitable for traders with varying styles, from short-term scalpers to long-term trend followers. Furthermore, the strategy works effectively in trending markets, providing clear signals for capturing significant price movements.

Another advantage is its objectivity. By relying on historical highs and lows, the strategy eliminates much of the emotional bias that can cloud trading decisions. Clear rules for entries and exits allow traders to focus on executing their plan without second-guessing themselves.

The Donchian Channel trading strategy also excels as a complementary tool. Many traders pair it with additional indicators, such as moving averages or oscillators like the MACD, to confirm signals and increase accuracy. This synergy enhances its effectiveness in dynamic forex markets.

Best Donchian channel strategies

Breakout strategy

The breakout strategy focuses on price movements beyond the channel’s boundaries. A close above the upper band signals a bullish breakout, while a close below the lower band indicates a bearish breakout. This method suits traders looking to capitalize on momentum-driven trends. To enhance accuracy, traders often combine this strategy with volume analysis or momentum indicators to confirm the breakout’s strength.

Trend following strategy

This strategy emphasizes staying in trades aligned with the prevailing trend. Traders enter long positions when the price breaks the upper band and remains above it, riding the uptrend. Conversely, short positions are initiated when the price breaks below the lower band. A moving average can be added to help identify the trend direction and filter out false signals.

Range-Bound strategy

In consolidating markets where price moves sideways, the Donchian Channel acts as a guide for trading reversals. Traders sell near the upper band and buy near the lower band, profiting from oscillating price movements. This approach is most effective when paired with momentum oscillators like the RSI to confirm overbought or oversold conditions.

Guide to implementing the Donchian channel trading strategy

Implementing the Donchian Channel trading strategy effectively requires a structured approach to ensure accuracy and consistency. Below is a step-by-step guide for applying this strategy in the forex market.

Setting up the indicator

Start by applying the Donchian Channel indicator on your trading platform, such as MetaTrader 4, TradingView, or other charting software. Most platforms allow you to customize the period, with 20-period channels being a common choice for identifying short to medium-term trends.

Identifying breakouts

Monitor price movements relative to the channel’s boundaries. A close above the upper band signals a potential bullish breakout, while a close below the lower band indicates a bearish breakout. This step is crucial for identifying entry points.

Confirming signals

Avoid relying solely on the Donchian Channel. Use complementary tools like the Relative Strength Index (RSI) to check if a breakout aligns with overbought or oversold conditions. Similarly, moving averages or MACD can help confirm the trend direction and filter out false signals.

Placing trades

Enter trades based on confirmed breakout signals. For a bullish breakout, initiate a long position and for a bearish breakout, open a short position. Set a stop-loss just below the middle or lower band for long positions and above the middle or upper band for short positions to manage risk.

Managing risk and exits

Define a profit target using the distance between the channel boundaries as a benchmark. Regularly review your position and adjust your stop-loss to lock in profits as the trade progresses.

Risks of the Donchian channel strategy

While the Donchian Channel strategy is a powerful tool for identifying trends and breakouts, it is not without its limitations and risks. Understanding these challenges is crucial for traders to avoid common pitfalls and refine their approach.

False breakouts

One of the most significant risks of the Donchian Channel strategy is false breakouts—temporary price movements outside the channel that fail to develop into sustained trends. In fast-moving or news-driven markets, such as forex, these false signals can lead to premature entries and losses. For instance, during a high-impact economic event, the EUR/USD may spike above the upper band, only to reverse shortly after.

Lagging nature of indicators

Donchian Channels rely on historical price data, which means they can lag behind current market conditions. This lag may result in late entries, particularly in rapidly trending markets. Traders relying solely on the channel may miss the optimal entry points, reducing the potential profit margin.

Limited use in ranging markets

The Donchian Channel strategy is most effective in trending markets. In range-bound conditions, where prices fluctuate within a narrow band, breakouts are less meaningful, and false signals become more frequent. For example, when trading USD/JPY during a consolidation phase, the strategy may produce multiple unprofitable trades.

Over-optimization

Excessive tweaking of the channel period can lead to over-optimization, where the strategy appears highly effective in backtesting but fails under real-world conditions. This can erode trader confidence and lead to inconsistent results.

Conclusion

The Donchian Channel strategy is a versatile and effective tool for forex traders seeking to identify trends, breakouts, and reversals in dynamic market environments. By leveraging the highest highs and lowest lows over a specific period, the strategy provides a clear, rule-based framework for making trading decisions. Its adaptability across various timeframes and compatibility with other technical indicators make it a popular choice for traders at all experience levels.

One of the key strengths of the Donchian Channel strategy is its objectivity. It minimizes emotional decision-making by offering definitive entry and exit points based on price action. Whether used to capture trending markets, navigate volatile conditions, or manage risks effectively, the strategy provides a structured approach to forex trading.