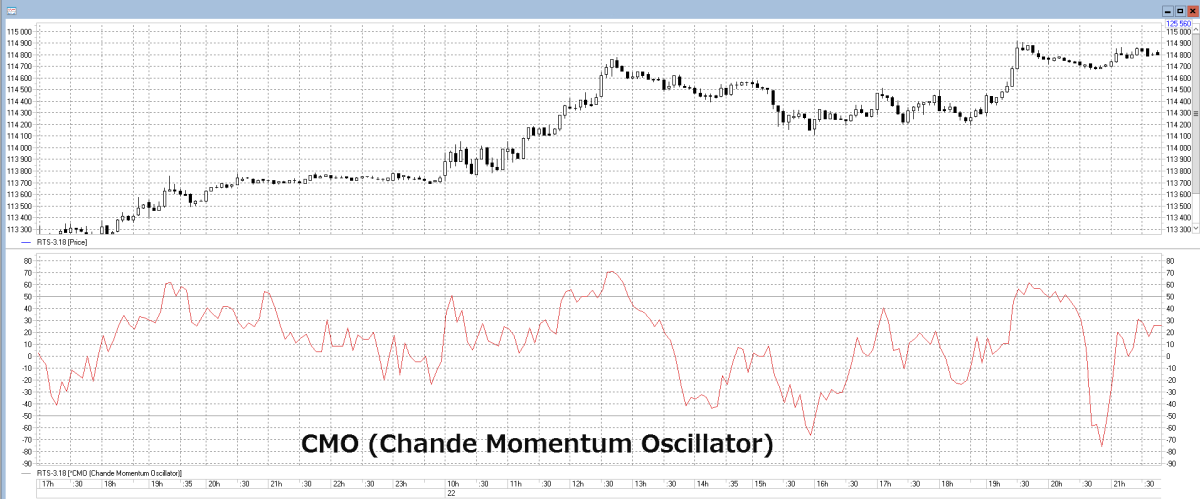

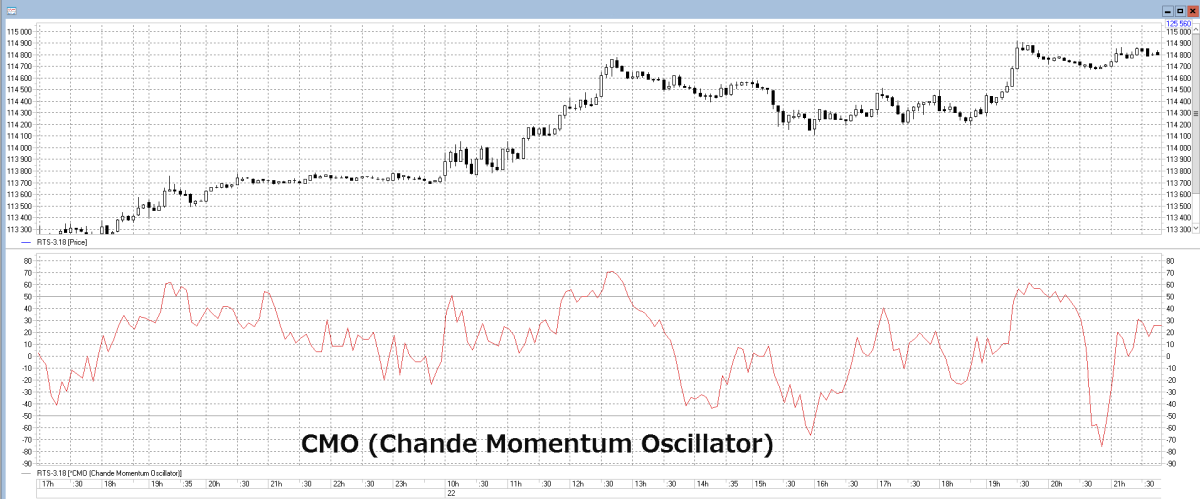

Chande momentum oscillator

The Chande Momentum Oscillator is designed to measure momentum by comparing gains and losses over a specified period. Unlike traditional oscillators like the Relative Strength Index (RSI), the CMO takes both upward and downward price movements into account, offering a more balanced perspective. This makes it particularly useful for identifying overbought and oversold conditions, as well as for detecting potential reversals in market trends.

Traders value the CMO not only for its accuracy but also for its adaptability. Whether you are a short-term trader seeking quick entry and exit points or a long-term investor looking to confirm broader trends, the CMO can be customized to suit your trading style. Moreover, its compatibility with popular platforms like MetaTrader 4 (MT4) adds to its accessibility and ease of use.

What is the Chande momentum oscillator?

The Chande Momentum Oscillator (CMO) is a technical analysis tool designed to measure the strength of price momentum in financial markets. Created by Tushar Chande, a respected figure in the field of market analysis, the CMO offers a unique perspective by incorporating both upward and downward price changes into its calculation. This approach sets it apart from many traditional indicators, which often focus solely on gains or losses.

Mathematically, the CMO is calculated by comparing the sum of recent gains to the sum of recent losses over a specific time period. The result is a value that oscillates between +100 and -100, providing clear insights into market conditions. A reading above +50 typically indicates overbought conditions, signaling potential price declines, while a reading below -50 suggests oversold conditions, pointing to potential price rebounds. Values near zero reflect a balanced market with no significant momentum in either direction.

In comparison to other oscillators like the Relative Strength Index (RSI), the CMO’s unique calculation provides a more nuanced view of market momentum. This makes it a favorite among traders who seek deeper insights into price dynamics and potential market reversals.

How the Chande momentum oscillator works

The Chande Momentum Oscillator (CMO) operates as a momentum-based indicator that evaluates the intensity and direction of price changes over a defined period. By comparing the magnitude of gains and losses, the CMO provides a balanced view of market dynamics, making it a valuable tool for traders seeking to understand price trends.

The CMO oscillates between +100 and -100, with readings indicating specific market conditions. When the oscillator moves above +50, it signals overbought conditions, suggesting that prices may soon reverse or enter a correction phase. Conversely, readings below -50 indicate oversold conditions, hinting at potential upward price movement. Values closer to zero reflect a neutral market with limited directional momentum.

A key feature of the CMO is its responsiveness to price fluctuations. This sensitivity allows traders to detect subtle shifts in market momentum, often signalling changes before they are visible on price charts. For example, a gradual rise from negative to positive values might indicate a strengthening bullish trend, while a sharp drop could suggest bearish pressure.

Chande momentum oscillator vs. other indicators

The Chande Momentum Oscillator (CMO) is often compared to other popular technical indicators, particularly those in the momentum family, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator. While all these tools aim to gauge market momentum, the CMO offers distinct advantages and unique characteristics that set it apart.

Unlike the RSI, which calculates momentum based solely on the size of price gains relative to losses, the CMO incorporates both upward and downward price movements equally. This balanced approach gives the CMO a broader view of market conditions, allowing traders to detect subtle shifts in momentum that the RSI might overlook. Additionally, the CMO’s range of +100 to -100 provides greater granularity, whereas the RSI is limited to values between 0 and 100.

When compared to MACD, which relies on moving averages to signal momentum shifts, the CMO is more immediate in its response to price changes. This makes it particularly useful for short-term traders who need quicker signals to capitalize on market fluctuations. However, unlike MACD, the CMO does not inherently highlight divergences between price and momentum, which can be a limitation in some trading scenarios.

The Stochastic Oscillator, another common tool, focuses on the closing price relative to its range over a set period. While effective for identifying overbought and oversold conditions, it is more susceptible to false signals in choppy markets compared to the CMO’s reliable calculation.

Chande momentum oscillator settings and customization

The effectiveness of the Chande Momentum Oscillator (CMO) largely depends on its settings and how well they align with a trader’s objectives and market conditions. By customizing the indicator’s parameters, traders can adapt it to suit different timeframes, trading styles, and instruments.

The default setting for the CMO typically uses a 14-period calculation, which is a balanced choice for many markets and trading strategies. This setting evaluates price momentum over the past 14 candlesticks, providing a mid-range sensitivity that works well for identifying trends and reversals in both trending and range-bound markets. However, traders can adjust the period to align with their specific needs.

- Short-term traders may reduce the period to 7 or 10 to increase sensitivity. This allows for quicker responses to price changes but may introduce more noise and false signals.

- Long-term traders might extend the period to 20 or 30, creating a smoother oscillator that reduces noise and focuses on broader trends.

Customization doesn’t end with the period. Traders can combine the CMO with other indicators to refine their strategies. For example, adding a moving average overlay to the CMO can help filter out false signals, confirming trends only when the oscillator aligns with the moving average direction.

Backtesting is critical when adjusting CMO settings. Analyzing historical performance helps ensure that the chosen parameters perform reliably in varying market conditions. Fine-tuning the settings to reflect the volatility and characteristics of the asset being traded can significantly improve the indicator’s reliability and utility.

Chande momentum oscillator trading strategies

The Chande Momentum Oscillator (CMO) is a versatile tool that can be integrated into various trading strategies to identify opportunities and manage risk effectively. Its ability to measure both upward and downward price momentum makes it particularly useful for traders seeking to navigate dynamic market conditions.

One popular approach is the Chande Forecast Oscillator Strategy, where traders use the CMO to confirm price reversals and trend continuation. In this strategy, a reading above +50 signals overbought conditions, prompting traders to look for potential short positions. Conversely, a reading below -50 suggests oversold conditions, offering opportunities for long entries.

For enhanced precision, traders often combine the CMO with other indicators. Pairing it with moving averages can help confirm trends, as a bullish crossover in the CMO supported by a rising moving average strengthens the validity of a buy signal. Similarly, using Bollinger Bands alongside the CMO helps identify breakout opportunities, particularly when the oscillator diverges from price movements near the band edges.

Support and resistance levels also work well with the CMO. For instance, when the oscillator signals overbought conditions near a resistance zone, it strengthens the case for a potential reversal. Similarly, oversold signals near support levels can point to upcoming price rebounds.

To mitigate risks, traders often incorporate stop-loss orders and position sizing rules. Backtesting these strategies ensures their effectiveness in different market environments, giving traders the confidence to execute them in live conditions.

Using the Chande momentum oscillator in MT4

MetaTrader 4 (MT4) is one of the most widely used trading platforms, known for its credible technical analysis tools and customization options. Integrating the Chande Momentum Oscillator (CMO) into MT4 allows traders to leverage its momentum-tracking capabilities directly on their charts for precise market analysis.

To use the CMO in MT4, begin by accessing the platform’s Indicators Library. If the CMO is not available by default, it can be added as a custom indicator through the platform’s marketplace or by importing an external file. Once installed, the indicator can be applied to any chart by selecting it from the “Insert” or “Navigator” menu.

Customization of the CMO settings within MT4 is straightforward. Traders can adjust the period length to align with their strategy, such as setting shorter periods for intraday trades or longer periods for swing trading. Additionally, the indicator’s visual properties, such as line color and thickness, can be modified to enhance clarity on the chart.

The real power of MT4 lies in its compatibility with multiple indicators. For example, traders can overlay the CMO with moving averages or Bollinger Bands to confirm signals. MT4 also supports automated trading scripts, allowing users to create algorithms that incorporate the CMO into trading strategies.

Conclusion

The Chande Momentum Oscillator (CMO) is an effective tool that offers traders a unique way to measure market momentum. By considering both upward and downward price movements, the CMO provides a balanced perspective that sets it apart from other oscillators. Its ability to signal overbought and oversold conditions, combined with its adaptability to different trading styles and market environments, makes it a valuable addition to any trader’s technical analysis toolkit.

As discussed, the CMO is not without its limitations. Its sensitivity to price changes can lead to false signals in volatile markets, and its lagging nature means it should not be used in isolation. However, these challenges can be mitigated by combining the CMO with complementary tools such as moving averages, Bollinger Bands, or support and resistance levels. Furthermore, thorough backtesting and the use of proper risk management strategies ensure traders can effectively navigate the risks associated with its use.